Features

A simple lesson in arithmetic on electricity sector

By Eng. Parakrama Jayasinghe

parajayasinghe@gmail.com

In February this year, I published an article titled, Sri Lankan Electricity Sector – The Headless Chicken (https://www.ft.lk/columns/Sri-Lankan-electricity-sector-The-headless-chicken/4-730564), and that was before Sri Lanka faced an unprecedented shortage of transport fuels, and long queues. The damage caused to the economy by diverting some 75% of the oil supplies to electricity generation is yet to be properly assessed. Therefore any observer including the smallest electricity consumer would agree with the above assessment, considering the sorry state that the once proud electricity sector has deteriorated to. This is by no means a sudden problem, but a repetition year after year even giving a new interpretation to what is meant by “Emergency Power”.

That Sri Lanka is subject to a dry spell every year from January to April does not require elaboration. However, the Ceylon Electricity Board (CEB) has chosen to ignore this reality and continues to do nothing to anticipate or mitigate the recurring problem year after year. Its solution has been to deploy costly emergency power generation, using imported oil. ignoring the very high cost of generation and as happened this year and the grave impact on the transport sector.

With the good fortune of more than usual rainfall, lasting beyond the southwest monsoon, the use of oil for power generation has been minimal over the past several months and the power cuts, too, have been limited to two hours per day. But, how long will that euphoria of ample hydro power last? Is there any possibility at all of the January to April dry spell not materialising?

The abyss facing us in a few short months

Maybe, Sri Lankans have already forgotten the miles long fuel queues. This story is set to be repeated in early 2023, too, with the Chairman of CEB, having already approved 100 MW of emergency power. In the meanwhile, the new long-term electricity generation plan (LTEGP 2023-2042 ) recently discussed at a public stake holder meeting proposes addition of 320 MW of emergency power now given a new name of “Short Term Supplementary Power”, nevertheless operated using expensive oil imported using the meager dollars resources, borrowed from increasingly reluctant lenders.

Sri Lanka paid a hefty sum in demurrages for the shipment of crude oil recently, which was lying in the out harbour for 56 days due to lack of dollars to pay for it. Where are the dollars coming from to pay for the proposed emergency power once the rains cease? The grave question of adequate supplies of coal to keep Norochcholai operational is hanging above us which will make the situation unbearable.These are the circumstances which prompted the tittle of this article.

The numbers game

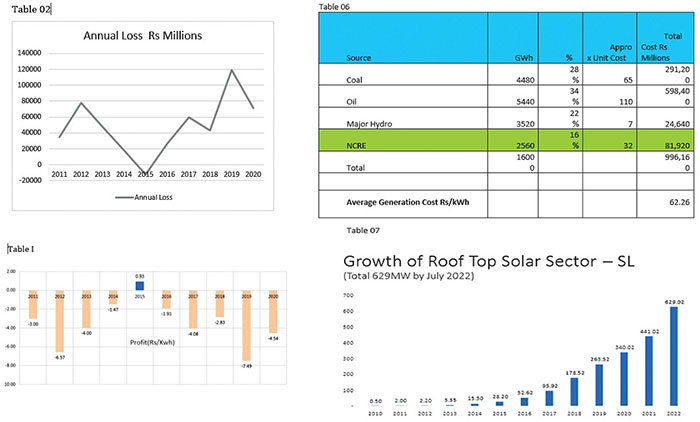

The CEB is fond of pinning the blame on the government for the continual losses they make year after year, claiming that its income is based on tariffs determined by others, and they are inadequate to cover the costs. This is only part of the story. The average income to the CEB thereby was about Rs 16.50 per unit whereas the average cost of generation continued to increase and was of the order of Rs 23.00 per unit before Covid-19 and the subsequent economic meltdown. As such the CEB losses kept mounting, as shown in Tables 1 and 2.

The annual losses per unit borne by the consumers

The Accumulated loss over this 10 year period is Rs. 484 Billion, with the rare instance of marginal profit in the year 2015.All of these losses were covered by the Treasury or are accumulated as bad debts in the two state banks and the CPC. This in other words means that the consumers at all levels have in reality paid an additional amount for every unit consumed.

However, why didn’t the CEB, or the Ministry of Power and Energy, or even the Treasury ask why the cost of generation cannot be lowered?So, my first lesson in Arithmetic is this; if ‘A’ is the cost of generation and ‘B’ the income, and if A >> B resulting in a negative value for C being the loss, and if A cannot be increased at will, why not lower B?

The CEB’s answer would be to say that its proposals for adding more coal power which in their books is the cheapest source of electricity was not permitted. The fact that coal is to be imported with dollars and the rupee continued to be depreciated and we have no control on the price of coal, does not enter into their reasoning. This is to be expected as their long term generation plans are based on the assumption that the price of coal does not change and the rupee does not depreciate. With that kind of mindset it is futile to continue this discussion with the CEB. Obviously they are also blind to the vast strides made the world over, where by many cheaper options for power generation have now been commercialized. Is this driven by pure ignorance, or willful misinterpretation of the realities of the sector or just lack of competence of the CEB engineers making decisions, are the unanswered questions, but with the net result of the present calamity faced by the nation.

The role of the Ministry of Power and Energy and the Treasury

But what about their superiors in the Ministry of Power and the custodians of the public purse in the Treasury? Do they, too, lack the simple knowledge in evaluating this equation and asking the obvious questions? In fact, I would lay the greater blame on the Ministry and the Treasury, for permitting the CEB to perpetrate this deception year after year, with total disregard for the interest of the country and its people. This blame is not limited to the present admiration, but must be laid at the feet of all previous regimes who also turned a blind eye on this problem for whatever reason.

The net result of this collective lack of accountability and blatant violation of responsibilities has been the current disaster and the even greater disaster waiting to unfold shortly. The disaster that would occur in early 2023, as the price of coal has sky rocketed and the best price quoted in the recent tender was $ 325 per ton. As such the line on coal has now got to be removed from the category of low cost generation in the CEB projection. (See Tables 03 and 04)

The Relative Costs prevailing prior to 2020 shown above clearly shows that even then the cheapest option was RE. This is the historical data before Sri Lanka faced the current crisis. However, it is interesting to see below the analysis of actual cost of coal power issued by the PUCSL in 2020. The myth of cheap electricity has been clearly debunked. Matters have worsened since then. The estimates revealed at the recent TV programme are shown below. The recent news items in Economy Next (22nd Nov 2022) tells the true story

” CEB loses Rs 108 bn up to August 22″

(See Table 05) With both escalated purchase prices of oil and coal the true cost of coal power would now reach over Rs 65 /kWh and that of oil over Rs 120/kWh, the prognosis for the next year is indeed alarming. Of the many NCRE options, which averaged only Rs 14.81 , well below the average income of the CEB, the true cause of this alarming loss is clear from the above chart.

It is time for the next lesson.

It is quite on the cards that the CEB loss will exceed Rs. 150 Billion for the year 2022. Thus based on the expected generation less than 15,000 GWhThe loss per kWh = 150,000,000,000/ 15,000,000,000 = Rs 10.00

This is not included in the monthly electricity bill even after the increased consumer tariff.So who bears this cost? You guessed it. The consumers including those consuming a mere 30 units a month and up to those consuming 3000 units a month in equal measure.

What awaits us round the corner?

In this light it was a breath of fresh air to note that Sri Lanka managed even for a few days with very little oil based generation in the past months, courtesy of the weather gods. However, this euphoria will be short lived and the rains are already dwindling. The damage is worsened by the fact that the cost of generation using oil and coal has reached such levels , so that any right minded admiration would shut down such plants immediately and seek whatever sustainable means of bridging the gap. (See Table 06)

Estimated generation cost for year 2023

These numbers are generally in line with those presented in the TV programme where the cost was predicted as Rs 900 Billion.So I dare not perform the next calculation of the loss per kWh which the consumers will have to bear albeit indirectly. That is unless something rational is done without any further delay.

The options available

Fortunately for Sri Lanka we have ample means of doing so, which does not result in continuous drain of Dollars and has the benefit of many other economic advantages. More details of these options have been submitted to the officials who hopefully would advise their political masters of the lack of any other alternative. This is where the third lesson in arithmetic becomes important. It was revealed that based on the current projections the total cost for the CEB in year 2023 is estimated as Rs 900 Billion. They cannot hope to get even 50% of that even with the recent 75% increase in consumer tariff resulting in a projected loss of over Rs. 450 Billion.

Who will bear this cost? What will that do to our balance of payments and the parity rate if it is also to be funded by the treasury? We will be entering a positive feed back loop in financial terms, the result of which the CEB engineers talking about stability of systems should understand.But what are those who are expected to mange the energy sector and more importantly the treasury which has blindly covered all the massive losses incurred by the CEB in past will at least now take some decisive actions.

Having wasted many years by obstructing the development of the Renewable Energy Sector, the options for any short term interventions are now limited to the Roof Top Solar systems. It is on record that with the help of the Surya Bala Sangraamaya which provided some degree of safety against those hellbent on disrupting it, some 650 MW of roof top solar has been now grid connected. Even now adding a further 100 MW at least in the next six months is technically possible if the authorities can do another simple sum in Arithmetic. (See Table 07)

It is seen that the average cost of generation would now be around Rs 62.00 per unit, if the present price of coal and oil stays and the rupee does not deteriorate any further. Also considering that what is even more important to consider is the availability of FOREX for the import of coal and oil, the decision on the tariff payable for the Roof Top solar, being the only short term solution should be against the cost of generation using coal and oil.

In this regard the industry experts have made detailed submissions that, under prevailing financial and economic considering the viable tariff to attract any investor to this sector would be Rs 50.00 – Rs 60.00 per unit based on size of installation. Naturally this could come down as hopefully the Sri Lankan economy improves in the coming years. But can we afford to wait till then. The alternative is to use emergency power costing more than double. So the simple question to be asked is , which number is higher?

Cost of Solar RT of Rs 50.00 per kWh or Cost of Coal of Rs 65.00 per kWh, (If we manage to buy some coal, which too is in doubt), and Cost of Solar RT of Rs 50.00 per kWh or Cost of Oil of Rs 120.00 per kWh Isn’t there any one at the CEB, PUCSL, or the Ministry of Power or The Ministry of Finance who can do these simple sums?

Unless there is some sanity even at this late hour to realize that the CEB must secure it energy by focusing on the facilitation of the indigenous, renewable sources of energy, which does not depend on imported fuels of any kind, Sri Lanka is rushing towards a disaster on unimaginable proportions in a few short months. Don’t be surprised if a further consumer tariff increase is round the corner and worse still the possible resumption of the petrol and diesel queues before long.