Opinion

Should only private sector employees pay income tax?

By Sanjeewa Jayaweera

Who currently amongst those who receive a salaried income is not on the streets protesting against the need to pay income tax? The obvious answer is only those working in the private sector. The private sector is often slammed for its reluctance to criticise the government for everything wrong with our country. So their reticence may once again result in only private sector employees paying income tax if the government caves into the demands of the public sector employees and trade unionists.

Based on media reports and television visuals, most state sector employees and those working in state-owned enterprises are on the streets demanding that they not be subject to income tax. Yes, a few say they don’t mind paying income tax but at a lower rate and whilst some demand greater transparency regarding how taxpayer money is spent. However, the overall impression created is that state sector employees don’t want to pay income tax.

As someone who worked in the private sector for nearly three decades and paid significant amounts as income tax, I, too, despised the lack of transparency and equity. However, I did not have the luxury of coming to the streets, refusing to pay the tax, or seeking judicial intervention. I had no choice. My employer deducted the tax and remitted the balance to my bank account.

Shockingly, those protesting against paying income tax are not on the breadline. I see there are two segments. The first lot is mostly public sector employees who are at least in middle management. The second is those in state-owned enterprises earning significantly high salaries and overtime despite being overstaffed.

Those working in the public sector who are out on the street are mostly university graduates who benefited from free education, demanded and received a government job, and earned a pension they never contributed to post-retirement. So their reluctance to pay income tax is perplexing, although many would put it down to the entrenched entitlement mindset.

GMOA IS ONCE AGAIN AT THE FOREFRONT

As usual, the Government Medical Officers Association (GMOA) has been the most vociferous of those objecting to increased income tax rates. That is not surprising because even in 2015, they went to the supreme court seeking relief from paying income tax at the highest rate then of 24%. When they failed, they approached the government requesting that doctors be categorised as part of the small and medium enterprises (SMEs) subjected to only 14%!

So it is unsurprising that they do not want to pay income tax at 36%. It amazes me that doctors, despite benefiting from free university education, the right to engage in private practice, and regular car permits have a great reluctance to pay income tax at the same rates as others. Many stories are circulating about how doctors ask patients to settle their fees in cash, particularly post-surgery, to avoid income tax on their fees.

The good doctors have been joined by judges, university professors, university teachers, engineers and bankers. The only lot that has not joined the protests are those working in the department of Inland Revenue! It would be ironic but not surprising if they do.

It is a shocking indictment of our country’s social fabric that the most supposedly educated citizens feel that they should not be paying income tax and that only those employed in the private sector should bear the income tax burden.

THE GOVERNMENT AND PARLIAMENT ARE NOT WALKING THE TALK

Having said that, I certainly endorse those who protest, saying there is a lack of will on the part of the government to reduce state expenditure and, of course, a lack of transparency as to how our taxes are spent and that rampant corruption is going unchecked.

The appointment of cabinet ministers and state ministers well above what is required solely for political expediency is a case in point. That those appointed are inefficient and some stand accused of corruption makes it even harder to digest.

The much-debated expenditure allocation of Rs 200 million for the independence day celebration whilst asking ordinary citizens to tighten their belts is proof of utter insensitivity and an entrenched mindset of political entitlement. Moreover, the explanation given by the President that the world might think that the country lacks the financial resources to celebrate independence day has left me and many other millions totally incredulous.

Several international aid agencies have assessed that over five million of the population cannot adequately feed themselves, and malnutrition among children is at an all-time high. In addition, foreign and local correspondents have filed media reports of the dire situation in our country. As such, the world is aware of our predicament, and this fact should not escape the President and his cabinet. So who are they trying to deceive?

A principle of good leadership is being able to “walk the talk.” In that respect, the President and his cabinet have been woefully lacking. My criticism is not just limited to the current President and cabinet. The parliament, which includes those in the opposition, can easily demonstrate their commitment to austerity measures that they demand from us by voting to curtail their benefits, such as closing down the parliamentary restaurant where it is claimed that sumptuous meals are served. In the overall context of government expenditure, it might be a meagre amount. However, they need to be seen “walking the talk”.

A media report reported that Rs 800 million had been spent on refurbishing a residence occupied by former President Mahinda Rajapaksa. If this report is indeed correct, then it is an abominable act by someone who keeps repeating that he is with the common person.

A recent report that the Kurunegala Municipal Council has spent Rs. 60 million to remove a stone at a construction site where a building was being constructed for a Maternity and Child Clinic, whereas the approved cost was Rs. 9.3 million reflects the corruption that permeates all state institutions. That none will be charged and jailed for this offence is guaranteed.

I have highlighted a few minor examples of taxpayer money being robbed and wasted. It is, therefore, not surprising that some feel that being subjected to income tax is unfair.

WIDEN THE TAX NET AND IMPOSE A 10% WITHHOLDING TAX ON INTEREST INCOME

There is no doubt that the tax net should be widened. Many liable to tax are not doing so as they are wilfully avoiding tax payment, with many not having a file at the IRD. It was recently reported that as many as 113 members of parliament do not have tax files. In many conversations, a question is raised whether all traders in Pettah have a tax file. From my experience in the private sector, I know that most wholesalers and distributors are either not paying taxes or what they pay is significantly understated. It is generally believed that most of the 500,000 grocery stores are not within the tax net. The IRD is at fault for not forcing these miscreants to register.

An eminently sensible proposal by Dr Nishan De Mel, head of the research agency Verite is to increase the withholding tax (WHT) on interest income to 10 per cent. He has argued that the additional tax collected would enable the government to give a tax reduction to those earning salaries above Rs 100,000 to maybe Rs. 500,000 per month. His suggestion is based on the assumption that most of our country’s “super rich” are underpaying taxes. Taxes collected as the source is guaranteed income for the state. An argument that may be put forward against this is that it will penalise pensioners who may not be liable for tax. The IRD issuing a tax direction can resolve this by confirming that the recipient is not liable for tax. The reluctance of the government to adopt the suggestion is perplexing, if not surprising.

THE NEED TO INCULCATE PAYING OF INCOME TAX AT A YOUNG AGE

Returning to why most state sector employees are reluctant to pay income tax, I believe that the reluctance has been ingrained in their DNA by successive governments by exempting them from income tax. This is because so many good social attributes are taught, and people are exposed to them at a young age.

In my case, my parents inculcated in me that I have a social responsibility to those underprivileged and, of course, the need to adhere to the law of any country I live. At 18, when I worked part-time as a petrol station attendant in the UK whilst studying, my salary was subject to income tax. Despite my nominal wage, I was conditioned to the need to pay income tax. It is the same discipline I adhered to during my working career, and even after my retirement pay my taxes every quarter without any underpayment or delay. It is the same for all private sector employees in our country, where the employer deducts income tax from the salary. So they are conditioned at an early age to the proverb, “Nothing is certain in life other than death and taxes.”

Those employed in state-owned enterprises have gotten used to the employer bearing the tax on their behalf. So the new rule that the employer will no longer be allowed to absorb the tax is causing them much distress. Yet, shockingly, such a scheme has been in existence. The mindset of state employees was illustrated when recently, an employee of the Ministry of Finance justified this practice by saying, “What does it matter whether the employer bears the tax? After all, the IRD receives the tax” It is a shocking reflection of the prevailing attitude.

It is a universally accepted social principle that those better off must contribute a fair share towards maintaining those less well off and other services that the state provides, either free or at subsidised price levels. The responsibility of paying income tax is even more critical in a society that has accepted free education and free health care should be a right of every citizen. It is, therefore, difficult to comprehend why our supposedly educated citizens who have immensely benefited from free education are now unappreciative of the need to repay the state and the citizens a fair share of their income. I am shocked that university professors and teachers, who are assumed to be a fountain of knowledge and appreciate social responsibilities, are also out on the street protesting against the increase in income tax rates. The same applies to those at the Central Bank, who should understand our economy’s perilous state more than others.

Opinion

Pope decries ‘major crisis’ of Trump’s mass deportation plans, rejects Vance’s theology

by Christopher White Vatican Correspondent

Pope Francis has written a sweeping letter to the U.S. bishops decrying the “major crisis” triggered by President Donald Trump’s mass deportation plans and explicitly rejecting Vice President JD Vance’s attempts to use Catholic theology to justify the administration’s immigration crackdown.

“The act of deporting people who in many cases have left their own land for reasons of extreme poverty, insecurity, exploitation, persecution or serious deterioration of the environment, damages the dignity of many men and women, and of entire families, and places them in a state of particular vulnerability and defencelessness,” reads the pope’s Feb. 11 letter.

Since taking office on Jan. 20, the Republican president has taken more than 20 executive actions aimed at overhauling the U.S. immigration system, including plans to ratchet up the deportations of undocumented migrants and halt the processing of asylum seekers.

The pope’s letter, published by the Vatican in both English and Spanish, offered his solidarity with U.S. bishops who are engaged in migration advocacy and draws a parallel between Jesus’ own experience as a migrant and the current geopolitical situation.

“Jesus Christ … did not live apart from the difficult experience of being expelled from his own land because of an imminent risk to his life, and from the experience of having to take refuge in a society and a culture foreign to his own,” writes Francis.

While the letter acknowledges the right of every country to enact necessary policies to defend itself and promote public safety, the pope said that all laws must be enacted “in the light of the dignity of the person and his or her fundamental rights, not vice versa.”

The pontiff also goes on to clearly reject efforts to characterise the migrants as criminals, a frequent rhetorical device used by Trump administration officials.

“The rightly formed conscience cannot fail to make a critical judgment and express its disagreement with any measure that tacitly or explicitly identifies the illegal status of some migrants with criminality,” the pope writes.

Soon after Trump took office, Vice President JD Vance — a recent convert to Roman Catholicism — attempted to defend the administration’s migration crackdown by appealing to St. Thomas Aquinas’ concept of ordo amoris.

“Just google ‘ordo amoris,’ ” Vance posted on social media on Jan. 30 in response to criticism he received following a Fox News interview.

During that interview, Vance said: “You love your family, and then you love your neighbour, and then you love your community, and then you love your fellow citizens in your own country. And then after that, you can focus and prioritise the rest of the world.”

While not mentioning Vance directly by name, Francis used his Feb. 11 letter to directly reject that interpretation of Catholic theology.

“The true ordo amoris that must be promoted is that which we discover by meditating constantly on the parable of the ‘Good Samaritan,’ that is, by meditating on the love that builds a fraternity open to all, without exception,” wrote the pope.

Since his election in 2013, Francis has become one of the world’s most vocal champions. His latest letter, however, marks a rare moment when the pontiff has directly waded into a country’s policy debates.

In the letter, however, he states that this is a “decisive moment in history” that requires reaffirming “not only our faith in a God who is always close, incarnate, migrant and refugee, but also the infinite and transcendent dignity of every human person.”

“What is built on the basis of force, and not on the truth about the equal dignity of every human being, begins badly and will end badly,” the pope warned.

In a brief post on social media, the U.S. bishops’ conference shared the pope’s letter with its online followers.

“We are grateful for the support, moral encouragement, and prayers of the Holy Father, to the Bishops in affirmation of their work upholding the God-given dignity of the human person,” read the statement.

(The National Catholic Reporter)

Opinion

Is Sri Lanka’s war on three-wheelers an attack on the poor?

For decades, three-wheelers—commonly known as tuk-tuks—have been a vital part of Sri Lanka’s transportation system. They provide an affordable and convenient way for people to get around, especially in areas where public transport is unreliable. However, successive governments have repeatedly discouraged their use without offering a viable alternative. While concerns about traffic congestion, safety, and regulations are valid, cracking down on three-wheelers without a proper replacement is unfair to both commuters and drivers.

For millions of Sri Lankans, three-wheelers are not just a convenience but a necessity. They serve as the primary mode of transport for those who cannot afford a private vehicle and as the only reliable last-mile option when buses and trains are not accessible. Senior citizens, people with disabilities, and those carrying groceries or luggage rely on tuk-tuks for their ease and accessibility. Unlike buses, which often require long walks to and from stops, three-wheelers offer door-to-door service, making them indispensable for those with mobility challenges.

In rural areas, where public transport is scarce, three-wheelers are even more critical. Many villages lack frequent bus services, and trains do not serve short-distance travel needs. Tuk-tuks fill this gap, ensuring people can reach markets, hospitals, and workplaces without difficulty. In urban areas, they provide a quick and affordable alternative to taxis and private vehicles, especially for short trips.

Despite their importance, three-wheelers have increasingly come under government scrutiny. Restrictions on new registrations, negative rhetoric about their role in traffic congestion, and limits on their operation in cities suggest that policymakers view them as a problem rather than a necessity. Authorities often cite traffic congestion, safety concerns, and lack of regulation as reasons for discouraging tuk-tuks. While these issues are valid, banning or restricting them without addressing the underlying transport challenges is not the solution.

The biggest flaw in the government’s approach is the absence of a proper alternative. Sri Lanka’s public transport system remains unreliable, overcrowded, and often inaccessible for many. Buses and trains do not provide efficient coverage across all areas, and ride-hailing services like Uber and PickMe, while convenient, are often too expensive for daily use. Without a suitable replacement, discouraging three-wheelers only makes commuting more difficult for those who rely on them the most.

Beyond the inconvenience to passengers, the economic impact of limiting three-wheelers is significant. Thousands of drivers depend on tuk-tuks for their livelihoods, and with rising fuel prices and economic instability, they are already struggling to make ends meet. Further restrictions will push many into financial hardship, increasing unemployment and poverty. For passengers, particularly those from lower-income backgrounds, losing three-wheelers as an option means higher transport costs and fewer choices.

Instead of discouraging tuk-tuks, the government should focus on improving and regulating them. Many countries have successfully integrated three-wheelers into their transport systems through proper policies. Sri Lanka could do the same by enforcing proper licensing and training for drivers, introducing digital fare meters to prevent disputes, ensuring better vehicle maintenance for safety, and designating tuk-tuk lanes in high-traffic areas to reduce congestion. These measures would make three-wheelers safer and more efficient rather than eliminating them without a backup plan.

The government’s push to restrict three-wheelers without providing a suitable alternative is both unfair and impractical. Tuk-tuks remain the only viable transport option for many Sri Lankans, particularly senior citizens, low-income commuters, and those in rural areas. Instead of treating them as a nuisance, authorities should recognise their importance and focus on making them safer and more efficient. Until a proper substitute is in place, discouraging three-wheelers will only create more problems for the very people who need them the most.

P. Uyangoda

Director-Education (retired)

Nedimala

Opinion

Government by the people for the people: Plea from citizenry

By an Old Connoisseur

The incumbent rulers keep on reminding the people, ad nauseam, that the current administration is a government for the people by the people. They have claimed the current government was born out of the uprising of the people.

All governments in democratic societies are born out of the will of the people. In such a context, all such governments have to work towards the well-being of the people with undiluted commitment. There is no doubt in the minds of even the most discerning citizens of Sri Lanka that all these promulgations are indeed the most noble of objectives and one would justifiably expect such contentions to even warm the cockles of the hearts of all and sundry.

Yet for all this, we do need to remember and firmly reiterate to our politicians that this principle should be the bedrock on which the political governance of any democracy is based. The people of a country should come first and foremost in all considerations of any legally elected democratic government. True enough, we do know for sure that even despite the very loud vocal grandiloquence of all previous governments, and I repeat all previous governments, they did not go even a little distance to hold the welfare of the people to be sacred, and their deeds and interests were completely at loggerheads with such an honourable foundation as well as essential and admirable attitudes. Without any significant exceptions, all previous political systems over the last 77 years of independence of our much-loved Motherland, have gone on record as institutions that put themselves first in all their considerations.

In point of fact, we also have to agree even unequivocally that this noble task cannot be achieved by the politicians alone. Politicians will have to take steps to stimulate, facilitate and unite all sections of society so that our people will put their collective shoulder to the wheel in a concerted initiative to lift up this country from the mire into which it has been pushed by politicians of various hues. Delving deeper into the depths of this contention, the question arises as to what or who are understood as people. In any society when one talks of people, we should focus on all people; the rich and the poor, the able and the disabled, the educated and the not so well educated, the employed and the unemployed, public-sector workers and the private-sector workers, the farmers as well as the white-collar workers, government enterprises as well as community organisations, and the business enterprises; in fact, the whole lot of Homo sapiens in our country. To improve the well-being of people we need the participation and unstinted cooperation of all these groups in our populace. An abiding sense of patriotism in the psyche of all of our people is definitely the need of the hour.

Politicians lay down the policies and the public sector ensures the implementation of these rules and regulations to improve the wellbeing of people. The public sector, including all politicians of different sorts, are servants of the people and are not deities with unlimited power just to take care of themselves and their political institutions as well as their kith and kin and acolytes. To realise these exalted goals we have to ensure that we have certain universal rules including respect for our people at all times, fair distribution of resources in an equitable manner, kindness, empathy and respect for the freedom of others, preservation and conservation of nature and the environment, adherence to the rule of law, unmitigated compliance with basic human rights and dignity, as well as the development of those very fine humane attributes such as beneficence, non-maleficence and altruism.

If we are to develop by transforming society by the people for the people, we will have to internalise and translate these attributes in our behaviour all the time and in all sectors of the community. Political leadership alone cannot do this honourable task. Society has to unite under these values and other attributes to be articulated and facilitated by the leadership. This is what many other progressive countries have attempted, some of them forging ahead with great success. For this to happen the entire society will have to work together over a long time with respect and minimal adversity. The stakeholders for this endeavour would be all individuals of society, Public Service including the political leadership, Private Sector and their leading figures and Community Organisations including their management. Every member of the population of our wonderful country should be invited to put his or her shoulder to the common wheel in a trek towards prosperity to enable everybody to enjoy an era of opulence.

The most admirable theme for the celebrations of our independence on the 4th of February this year was “Let us join the National Renaissance”. It was a clarion call to enable us to rise up like the proverbial phoenix from the ashes towards a magnificent revival. In addition to all that has been written above, the government and its leadership, for their part, have an abiding duty to take all necessary steps to facilitate the revitalisation of patriotism to urge the populace to contribute to the prospect of national resurgence. Towards that end, the general public has to be happy in this thrice blessed land and they need to live in a country that is safe and affluent. The powers that be need to realise most urgently that unless corruption is completely eliminated, the drug lords effectively neutralised, murderers and other law-breakers swiftly brought to book, various Mafia-type impertinent audacious organised collectives such as Rice Millers, Egg Manipulators, Coconut Wheeler-dealers, and Private Transport Syndicates; all of which hold the public to ransom, are ruthlessly tamed, there is no way in which we can rise and march towards any kind of Nationwide Resurgence. Of course, equally importantly, the farmers who provide sustenance to the entire nation should be looked after like royalty. It is also ever so important that vital and purposeful steps are taken to develop the rural impoverished areas and take steps to alleviate the poverty of the downtrodden. If these things are not attended to, at least for a start, the grandiose but implausible and tenuous rhetoric of that call to rally would just be a ‘pus vedilla’, and could even be a virtual non-starter.

-

Business3 days ago

Business3 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports4 days ago

Sports4 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

News6 days ago

News6 days agoKiller made three overseas calls while fleeing

-

News5 days ago

News5 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features4 days ago

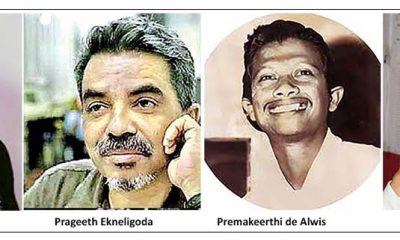

Features4 days agoThe Murder of a Journalist

-

Sports4 days ago

Sports4 days agoMahinda earn long awaited Tier ‘A’ promotion

-

Features4 days ago

Features4 days agoExcellent Budget by AKD, NPP Inexperience is the Government’s Enemy

-

News5 days ago

News5 days agoMobile number portability to be introduced in June