Business

Day of fluctuating fortunes at CSE but both indices rise

By Hiran H.Senewiratne

In a day of fluctuating fortunes, at the beginning of operations yesterday the stock market was positive, by mid-day it turned negative but later recovered, stock market analysts said.In the international arena, the European Union Central Bank is likely to do an interest rate hike soon. Besides, the high temperature levels experienced by most European countries due to climate change will likely impact global stock markets, market analysts added.

Amid those developments both indices moved upwards. The All-Share Price Index went up by 24.3 points and S and P SL20 rose by 8.87 points. Turnover stood at Rs 1.29 billion with a single crossing. The crossing took place in JKH, which crossed 1.1 million shares to the tune of Rs 128.5 million, its shares traded at Rs 120.

In the retail market top event companies that mainly contributed to the turnover were; Browns Investments Rs 255.6 million (31.4 million shares traded), Lanka IOC Rs 152.7 million (1.9 million shares traded), Expolanka Holdings Rs 119 million (654,000 shares traded), Sunshine Holdings Rs 56 million (1.7 million shares traded), Softlogic Holdings Rs 50.5 million (791,000 shares traded), Hayleys Rs 46.1 million (634,000 shares traded) and JKH Rs 44 million (364,000 shares traded). During the day 71.1 million share volumes changed hands in 15713 transactions.

It is said that high net worth and institutional investor participation was noted in John Keells Holdings. Mixed interest was observed in Expolanka Holdings, Lanka IOC and Hayleys, while retail interest was noted in Browns Investments, SMB Leasing non-voting and Kotagala Plantations.

The Food, Beverage and Tobacco sector was the top contributor to the market turnover (due to Melstacorp and Browns Investments), while the sector index gained. A share price increase was witnessed in Sunshine Holdings, whose shares appreciated by 11.5 per cent or Rs 3.50. Its share price shot up to Rs 34 from Rs 30.50.

The Capital Goods sector was the second highest contributor to the market turnover (due to JKH).Expolanka Holdings and Lanka IOC were also included among the top turnover contributors. The share price of Expolanka Holdings recorded a gain of 25 cents to close at Rs. 180.25. The share price of Lanka IOC appreciated by 70 cents to close at Rs. 77.80.

Yesterday, the Central Bank- announced US dollar buying rate was Rs 358.31 and selling rate Rs 368.91. Sri Lanka needs to accelerate fiscal reforms to bring back economic stability, and a stable government to carry them out, the Central Bank Executive Officers’ Union has warned.

Business

Global Insurance leaders to converge in Colombo for MDRT Sri Lanka Day 2026

In a first for Sri Lanka’s insurance industry, the country will host MDRT Sri Lanka Day 2026, also known as International Insurance Day, bringing together global leaders, professionals and organisations from the international financial services and insurance sectors.

The initiative, organised by the Million Dollar Round Table (MDRT), will mark Sri Lanka’s inaugural MDRT Day and is scheduled to be held on 18 May 2026.

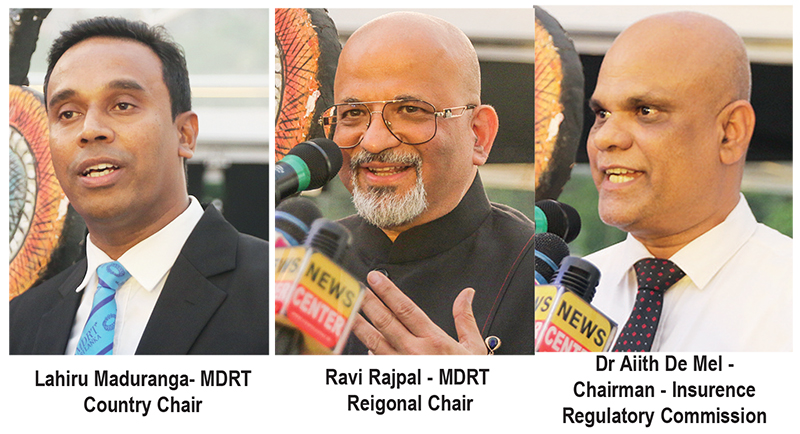

MDRT Country Chair – Sri Lanka, Lahiru Maduranga, said the event would provide a significant opportunity to position Sri Lanka on the global insurance and financial services map.

“This is an excellent opportunity for Sri Lanka to host such a prestigious event and to promote the country’s standing globally,” Maduranga said.

He made these remarks at the official sundown launch announcing the event, held on 26 January at 8 Degrees on the Lake, Cinnamon Lakeside, Colombo.

The launch was attended by the Chairman and Director General of the Insurance Regulatory Commission of Sri Lanka, chief executive officers of insurance companies, and regional and zonal chairs of MDRT, at which the official date of MDRT Sri Lanka Day 2026 was unveiled.

Maduranga said the landmark event aims to bring the spirit and experience of the MDRT Annual Meeting to the Sri Lankan MDRT community. The programme will feature the MDRT President, Executive Committee members and internationally renowned speakers, offering world-class insights, inspiration and professional development aligned with MDRT values.

He noted that many Sri Lankan MDRT members face challenges in attending the Annual Meeting overseas due to foreign exchange constraints and visa limitations. Of more than 1,200 MDRT achievers in Sri Lanka, only around 50 were able to attend the Annual Meeting in the United States.

“This initiative marks a significant step forward in strengthening the MDRT culture in Sri Lanka and in elevating professional standards within the local insurance services sector,” Maduranga said.

The MDRT Membership Communication Committee (MCC) serves as the official liaison between MDRT Headquarters in the United States and the Sri Lankan MDRT community, overseeing communication, engagement and coordination with the local financial services sector.

Founded in 1927 in the United States, the Million Dollar Round Table (MDRT) is the world’s most prestigious association of insurance and financial services professionals. MDRT represents the highest standards of professional excellence, ethics and performance in the industry. Its Annual Meeting, traditionally held in the United States, attracts more than 10,000 top-performing members from around the world each year.

By Hiran H Senewiratne

Business

ESOFT UNI Kandy leads the charge in promoting rugby among private universities

With the aim of fostering a passion for rugby among students in private universities and higher education institutes across Sri Lanka, ESOFT UNI Kandy has launched a special sports development initiative.

As a part of this program, a series of rugby encounters were recently organized between the ESOFT UNI Kandy rugby team and the SLIIT Kandy Uni rugby team. The matches were held at the Peradeniya University Rugby Grounds.

Two highly competitive matches were played during the event. In the first game, the ESOFT UNI Kandy rugby team secured a victory over SLIIT Kandy Uni with a score of 17-07. They maintained their winning streak in the second match as well, defeating their opponents with a final score of 12-07.

This initiative is seen as a significant step toward building a robust sporting culture within the private higher education sector in the hill capital.

The initiation has been started with Rugby and will soon be extended to Cricket, Football, Martial Arts, Badminton, Hockey, Chess, and other areas of sports as well. ESU believes that the development of soft skills, parallel to higher education, will help shape highly capable, industry-ready, and employable students who can confidently face any personal and professional challenges they encounter during their journey.

Dimuthu Thammitage, General Manager, ESU Central Region said: Today’s job market demands highly employable individuals who possess not only educational qualifications but also strong soft skills, which can be effectively developed through sports. Therefore, we warmly invite other educational institutions to join hands with us in producing highly employable students together through sports.

Lakpriya Weerasinghe, Deputy General Manager, ESU Kandy said: At ESOFT Uni, we believe that sports play a vital role in improving students’ personalities through the development of essential soft skills. Therefore, we encourage our students to actively join our clubs and enhance their soft skills alongside their academic education.

Oshara Chamod Bandara, MIC Rugby Club, ESU Kandy said: Sports are iconic to Kandy. As the MIC of the ESU Kandy Rugby Team, I am truly happy to see the enthusiasm of our students towards sports while actively engaging in their studies. I warmly invite other students to join our clubs and further develop their skills alongside their academic journey.

Text and Pix By S.K. Samaranayake

Business

Altair issues over 100+ title deeds post ownership change

Altair Residences have, over the past six months, seen more than 100 individual title deeds being executed by apartment owners, providing owners with a clear, registered, legal title to their apartments in accordance with Sri Lankan property law. This has been a key initiative by the new owners and management of Altair to improve governance and will continue in an orderly manner in the coming months.

With the transition of ownership to Blackstone India, Altair’s Management Council has also been formally constituted, enabling owners to play an active and proactive role in the management of the Altair building. In addition, the management council has appointed Realty Management Services (RMS), a subsidiary of Overseas Realty Ceylon PLC, as the new facility manager of Altair.

Commenting on these milestones, Thilan Wijesinghe, Chairman of TWC Holdings, who, together with a team from TWC, represents Blackstone’s interests in Sri Lanka, said, “The issuance of individual title deeds is a critical step in any professionally developed residential asset. Over the past six months, this process at Altair has moved forward in a structured and transparent manner, alongside the formal establishment of owner-led governance. This, combined with the appointment of experienced facility managers are fundamental building block for long-term value-creation for apartment owners and proper asset stewardship.”

With ongoing improvements to the building being undertaken by Indocean Developers Pvt Ltd (IDPL), the owning company of Altair, the issuance of deeds to owners is expected to accelerate over the coming months.

-

Business6 days ago

Business6 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business3 days ago

Business3 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion2 days ago

Opinion2 days agoSri Lanka, the Stars,and statesmen

-

Business1 day ago

Business1 day agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Opinion6 days ago

Opinion6 days agoLuck knocks at your door every day

-

Business1 day ago

Business1 day agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business1 day ago

Business1 day agoArpico NextGen Mattress gains recognition for innovation

-

Editorial1 day ago

Editorial1 day agoGovt. provoking TUs