Business

Significance of repatriation and conversion of export proceeds for external sector stability and overall financial system stability

Sri Lanka’s merchandise export sector has shown a notable improvement in 2021 compared to the pandemic-affected 2020. As per the latest Customs data, export earnings have averaged US dollars 985 million during the eight months ending August 2021 compared to a monthly average of US dollars 837 million in 2020, while the average earnings have amounted to US dollars 1,064 million during June-August 2021. This is an appreciable development as the merchandise export sector (comprising diverse products) is the largest foreign exchange earner in most countries, including Sri Lanka.

Sri Lanka has had a trade deficit each year since 1977, and the gap between merchandise imports and exports is typically financed by other inflows to the external current account (such as tourism and other services inflows as well as workers’ remittances), and financial inflows (such as investments and borrowing).

In this background, some recent developments in the foreign exchange market have raised several concerns, particularly as some of these typical avenues of foreign exchange inflows have been affected due to pandemic-related pressures, as explained below:

a) Compared to the monthly average exports as reported by Customs (goods flow) of US dollars 985 million during the eight months ending August 2021, the monthly average repatriation of export proceeds during July/August 2021 has been US dollars 640 million as reported by banks (financial flow). Accordingly, there has been a significant gap of US dollars 345 million between these two figures. This observation therefore, raises the serious question as to whether exporters comply with the regulation on 100 per cent repatriation of export proceeds.

b) It also appears that due to an undue speculation on exchange rate movements, there has been a reluctance to convert export earnings during the period from January 2020 to July 2021, thereby limiting inflows to the domestic foreign exchange market, which situation has then resulted in a buildup of foreign currency deposit balances with the banking sector by a significant US dollars 1.9 billion. In addition, with low rupee interest rates, some exporters have found it more lucrative to borrow and import to meet their input requirements, leading to further tension in the domestic market.

c) As per the data available, it would also be noted that if there had been a 100 per cent repatriation and 100 per cent conversion of export proceeds, the monthly export foreign exchange flow into the domestic market would have been US dollars 985 million, and with the average expenditure on imports of US dollars 1,670 million, that would have resulted in a monthly average gap of US dollars 685 million. This could have been easily financed using other foreign exchange inflows into the country.

d) Based on the above past statistics in general, and the experience during July/August 2021 in particular, the monthly average gap between the conversions of export proceeds with an incomplete repatriation and expenditure on imports has been quite alarming.

It would also be fair to state that there is a necessity for a country to ensure that the foreign exchange generated through export activities are duly repatriated into the country and converted into its currency. In fact, many emerging market economies have repatriation and conversion requirements imposed on merchandise and services exports. Country experiences vary, and over time, with the buildup of a country’s foreign exchange reserves through such non-debt inflows, countries have also gradually relaxed these requirements. Regional economies such as Bangladesh, India, Indonesia, Malaysia, Nepal, Pakistan, and Thailand have export proceeds repatriation requirements currently in place varying from 3 months to 2 years of the export. Bangladesh, India, Pakistan and Thailand have repatriation requirements on both goods and services export proceeds, while in Nepal, Malaysia and Indonesia, the repatriation requirement is only applicable on goods exports. Bangladesh, India, Pakistan and Thailand have rules on conversion to respective local currencies in different percentages based on nature and the amount of repatriated export proceeds and their utilisation. Such repatriation and conversion requirements ensure the fulfillment of the demand for foreign currency, including intermediate and investment goods imports directly required by the export sector, as well as essential fuel and medical requirements of the country, which are indirect inputs to all sectors including the export sector.

Therefore, it would be reasonable for the Government (which supports the export sector through lower taxes and numerous other incentives) and the Central Bank (which is expected to deliver price and economic stability as well as financial system stability) to take steps to ensure the complete repatriation of export proceeds within a reasonable period and the conversion of inflows of export proceeds into the local currency, including the proceeds already accumulated in exporters’ accounts, so that the true purpose of exports is realised.

As would be well appreciated, an export would realise its objective only when it finally culminates in the flow of foreign exchange that is generated by the export into the country’s financial system in its local currency. That objective would obviously not be fulfilled if the final conversion of export proceeds into local currency does not take place. Accordingly, steps must be taken to strengthen the systems to ensure monitoring and to implement measures that lead to this objective. It is only then that the gap between the foreign exchange liquidity provided through exports and the foreign exchange liquidity demand for imports would reduce to the level as published in the Central Bank’s own reports.

Business

JICA and JFTC support Sri Lanka’s drive for economic growth through a fair and competitive market

The Japan International Cooperation Agency (JICA) and the Japan Fair Trade Commission (JFTC) have expressed their support for policy reforms and institutional enhancements aimed at ensuring the supply of high-quality goods and services in Sri Lanka while safeguarding both consumers and producers.

This was discussed at a meeting held on Wednesday (12) at the Presidential Secretariat between representatives of these organisations and the Secretary to the President, Dr. Nandika Sanath Kumanayake.

During the discussion, the representatives emphasized that establishing fairness in trade would protect both consumers and producers while fostering a competitive market in the country. They also emphasized how Japan’s competitive trade policies contributed to its economic progress, explaining that such policies not only help to protect consumer rights but also stimulate innovation.

The secretary to the president noted that this year’s budget has placed special emphasis on the required policy adjustments to promote fair trade while elevating Sri Lanka’s market to a higher level. He also briefed the representatives on these planned reforms.

The meeting was attended by Senior Additional Secretary to the President, Russell Aponsu, JICA representatives Tetsuya Yamada, Arisa Inada, Yuri Horrita, and Namal Ralapanawa; and JFTC representatives Y. Sakuma, Y. Asahina, Y. Fukushima, and M. Takeuchi.

[PMD]

Business

World seen to be at crucial juncture as competition mounts for strategic resources

By Ifham Nizam

The intersection of climate change, energy security and global politics has never been more crucial, with geopolitical conflicts increasingly driven by competition over fossil fuels and critical minerals. Mayank Aggarwal, an energy and climate expert from The Reporters’ Collective, highlights this in his work, ‘Geopolitical Energy Chessboard’.

“Climate change and energy security are two of the most pressing global challenges, Aggarwal explains. “Urgent climate action is needed to mitigate its impact, but reducing fossil fuel use and transitioning to cleaner energy is a politically charged issue, he told The Island Financial Review.

His research highlights the complex web of energy politics, particularly in South Asia, where one in four people on earth reside. “South Asia is a major importer of fossil fuels and its energy security is critical. But the region also lacks a comprehensive dialogue framework to address climate and energy challenges collectively, he notes.

Aggarwal emphasizes that energy conflicts are not just national concerns but extend to the global stage. “From Libya and Iraq to Ukraine and Venezuela, conflicts over oil, gas, coal and critical minerals are shaping international relations. These disputes threaten economic stability and development goals worldwide.”

Despite the urgent need for a clean energy transition, political and economic interests delay global cooperation. “Countries are pulling out of climate agreements, favoring bilateral deals that often sideline developing nations. While global clean energy transition is essential, the geopolitical hurdles remain significant, Aggarwal warns.

He calls for a “Just Energy Transition” that ensures energy security and independence while engaging communities in decision-making. “We need regional cooperation, transparent negotiations for resource-rich areas and strong political will to drive climate and energy discussions at all levels, he concludes.

As the world grapples with escalating climate disasters and energy crises, Aggarwal’s insights highlight the urgent need for a balanced, just, and cooperative approach to energy politics.

Business

SEC Sri Lanka engages in interactive knowledge-sharing forum with University of Ruhuna

The Securities and Exchange Commission (SEC) of Sri Lanka recently participated in the Capital Market Forum 2025, organized by the Department of Accountancy and the Department of Finance of the Faculty of Management and Finance at the University of Ruhuna, in collaboration with the Colombo Stock Exchange (CSE). This interactive knowledge-sharing forum aims to enhance financial literacy and promote capital market participation among undergraduates and academics.

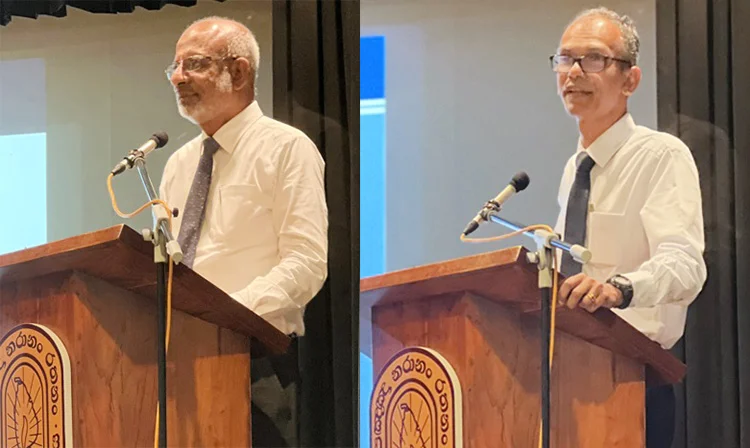

A key highlight of the forum was the workshop on “Nurturing Future Investors: The Role of Capital Markets in Personal and Economic Growth,” which featured distinguished speakers, including Senior Professor Hareendra Dissabandara, Chairman of the SEC, and Tushara Jayaratne, Deputy Director General of the SEC.

Senior Professor Hareendra Dissabandara delivered a compelling lecture on the crucial role of capital markets in fostering economic development. He emphasized how capital markets facilitate efficient capital allocation and contribute to long-term economic stability. A key focus of his discussion was the significance of capital formation as a sustainable alternative to debt financing for government projects. He illustrated this by comparing the market capitalization of a leading Sri Lankan company with the costs of several major government initiatives.

Professor Dissabandara highlighted the historical reliance on borrowing for infrastructure development in Sri Lanka, leading to fiscal imbalances, high-interest burdens, and economic vulnerabilities. He underscored the importance of equity financing in business sustainability, emphasizing that an efficient financial market channels surplus funds from households, institutions, and foreign investors into businesses and government projects. He explained that for over 70 years, successive governments have relied on borrowing to fund infrastructure and development, causing fiscal imbalances, rising interest burdens, high taxation, and economic vulnerabilities. He also noted that corporate professionals often overlook the importance of equity financing for sustainable growth.

-

News5 days ago

News5 days agoPrivate tuition, etc., for O/L students suspended until the end of exam

-

Features6 days ago

Features6 days agoShyam Selvadurai and his exploration of Yasodhara’s story

-

Editorial4 days ago

Editorial4 days agoRanil roasted in London

-

Latest News5 days ago

Latest News5 days agoS. Thomas’ beat Royal by five wickets in the 146th Battle of the Blues

-

News5 days ago

News5 days agoTeachers’ union calls for action against late-night WhatsApp homework

-

Editorial6 days ago

Editorial6 days agoHeroes and villains

-

Features4 days ago

Features4 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Editorial5 days ago

Editorial5 days agoPolice looking for their own head