Business

Policy rates to hold steady amidst sweeping measures to insulate economy: First Capital

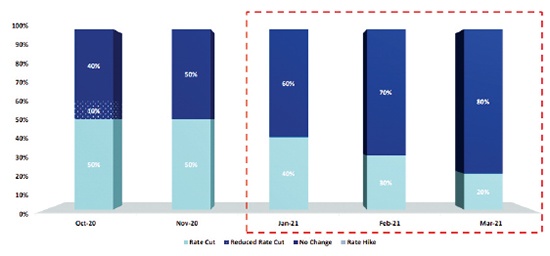

First Capital Research believes that the Central Bank of Sri Lanka (CBSL) will maintain same policy stance in its monetary policy review, but given the concerns around economic growth, the research arm also supposes that there is a probability – to a lesser extent – that CBSL is likely to further ease its policy rates.

” The CBSL either can choose to hold policy rates steady or cut by a 25bps or 50bps while, hike is off the table due to the lackluster economic growth. We believe that there is a 60% probability to hold rates due to the considerable improvement in high frequency indicators and with fiscal and monetary measures implemented so far. However, there is a 20% probability each for 25bps and 50bps rate cut to support economic growth,” First Capital Research said in its latest report.

At the previous policy meeting held on November 2020, CBSL maintained its monetary policy stance, emphasizing the fact that overall market lending rates have witnessed a reduction during 2020 and there is a need for a continued downward adjustment in lending rates to boost economic growth. Moreover, introduction of maximum interest rates on mortgage- backed housing loans is expected to provide additional stimulus to the economy.

The next CBSL’s monetary policy review is scheduled to be announced on 19th January 2021 at 07.30 am.

The research arm further stated that excess liquidity prevailing in the domestic market requires no change in current policy stance.

“As a response to the measures taken by the Government, market liquidity increased to an elevated level while recording a three-year high on 1 January 2021 amounting to Rs. 266.5 billion. Accordingly, this excess liquidity in the system is expected to retain market interest rates at single digit levels while inducing further credit expansion. This inquires the need of further policy easing at the upcoming review,” it said.

It further stated that there is gradual rebound in private credit to power economic growth.

“Private sector credit increased by LKR 41.0Bn in Nov 2020 recording a growth for the fourth consecutive month indicating a revival in gross loan disbursements up to pre-pandemic levels in Dec 2019. The continuous uptrend in private sector credit till Nov 2020 reflects that both businesses and individuals are accelerating their economic activities to make up for the lost opportunities during lockdowns in the first wave of COVID, which could power decent growth in 4Q2020 and onwards,”

In response to previous monetary easing measures implemented by CBSL, (including the lending caps) to bring down costs of borrowing of businesses and households, both market deposit and lending rates adjusted notably so far during 2020.

First Capital Research believes these measures will enable to maintain market interest rates at stable levels in 2021 while playing its aiding role amidst the pandemic driven economic contraction.

Meanwhile, the research arm estimates that Sri Lanka’s GDP would see its steepest contraction in history of -5.8% in 2020 and to see a gradual recovery of 2.8% in 2021.

“The current government’s key drive is the development oriented economic growth which was spelled out through the Budget 2021 and is in the process of changing gears of the economy from a “recovery phase to an expansion phase. Accordingly, Government plans to reach 6% and above GDP growth during the next 5 years commencing from 2021. As we believe a development oriented budget coupled with low interest rate environment can support the Govt.’s medium-term goals. Therefore, the need to accelerate the GDP growth can be considered as a major factor favouring further policy easing at the upcoming review,” it said.

“Government is more focused on domestic funding to finance the budget deficit. This is reflected by the improved domestic to foreign debt ratio to 55:45 by end Sep 2020 from the previous 51:49 as at end of 2019. In the midst of limited access to the international financial markets, Government opt to rely more on domestic borrowings to finance the budget deficit and hence easing rates at the upcoming policy meeting results in reduced funding cost favouring the government,” it added.

Business

DevPro and WCIC come together to accelerate women’s economic empowerment in Sri Lanka

DevPro and Women’s Chamber of Industry and Commerce (WCIC) signed a formal partnership on Wednesday, 28th January to collaborate in promoting women’s economic empowerment and inclusion in Sri Lanka.

DevPro builds on 30 years of OXFAMs legacy in Sri Lanka and works towards Inclusive Economic Development leveraging expertise in inclusive and climate-resilient market systems and enterprise development and innovation. DevPro’s work is guided by the core values of gender justice, inclusivity and community-led development. Through its recent projects, DevPro has supported over 270 women-led MSMEs, across agriculture, handloom, and tourism-related value chains in five provinces in Sri Lanka through a mix of interventions combining skills development, enterprise strengthening, market linkages, and gender-sensitive community engagement to improve income, resilience, and economic participation.

WCIC is the first women-only trade chamber in the world, dedicated to empowering women entrepreneurs and women-led MSMEs in Sri Lanka through skills-building, business advisory services, networking etc. Among its many initiatives, WCIC’s flagship annual event, “Prathibhabhisheka” – Women’s Entrepreneurs Awards has empowered many women owned and women-led businesses in Sri Lanka to enhance their business resilience and competitiveness through improved governance processes, financial health, market recognition and global expansion.

Through this partnership, both DevPro and WCIC, will leverage their collective expertise, networks and resources to advance women’s economic empowerment and inclusion through projects, capacity building, research and policy advocacy focused on women entrepreneurship development, innovative business models, sustainability certification and credentials, export readiness and market integration and financial literacy and inclusion.

The MoU was signed by Gayani de Alwis, Chairperson of WCIC and Chamindry Saparamadu, Executive Director of DevPro in the presence of senior members of both teams.

Business

Writer Business Services enters Sri Lanka to partner with institutions to provide information management and payments solutions

Writer Corporation, one of India’s leading business groups, announced the launch of its subsidiary, Writer Business Services Pvt. Ltd., and the commencement of its operations in Sri Lanka. The expansion reflects Sri Lanka’s strategic importance in Writer’s regional growth plans and its role in supporting a highly regulated digital and financial services market which is currently undergoing digital transformation.

Sri Lanka’s continued focus on strengthening regulatory frameworks, digital platforms, and financial systems is shaping how institutions across banking, government, and enterprise sectors approach their business operations. There is a clear emphasis on secure, compliant, and resilient information and transaction environments that can scale with regulatory and business needs. Writer’s entry into Sri Lanka aligns with this direction, bringing global experience and a partnership-led approach to the market.

As part of its launch, Writer will establish a secure records and information storage facility in Seeduwa, Colombo. Designed to meet global standards for security, compliance, and disaster resilience, the facility will support banks, financial institutions, government bodies, and large enterprises in managing physical and digital information across its lifecycle.

Alongside information management, Writer brings established expertise in integrated payment services to support the modernization of transaction infrastructure across the banking and financial services sector. Its payments capabilities focus on strengthening availability, transaction continuity, and transparency across critical payment channels that underpin institutional reliability and customer confidence.

Writer’s digital payments offerings in Sri Lanka include end-to-end ATM and self-service terminal outsourcing, integrated channel ownership and managed services, field management applications, payment and reconciliation platforms, and remote monitoring with near real-time reporting. These solutions support financial institutions in improving uptime, strengthening governance, and enhancing operational efficiency across payment networks, in line with the continued evolution of electronic and automated payment systems.

Across information management and payments, Writer operates with an integrated portfolio spanning records and information management, business process outsourcing, cloud and digital services, data privacy, cybersecurity and enterprise payments infrastructure. These capabilities support institutions in addressing evolving regulatory requirements, digitization of legacy environments, and rising operational and cyber risks.

Writer’s local presence enables closer collaboration with clients and on-ground delivery, while supporting the development of Centres of Excellence across cybersecurity operations, SOC and NOC services, AI-led solutions, and payments operations and monitoring.

Writer’s Sri Lanka operations will be built, led, and run by Sri Lankan professionals, reflecting a long-term commitment to local talent growth and development.

Commenting on this development, Satyamohan Yanambaka, CEO, Writer Global Services Pvt. Ltd., assured Writer’s long-term commitment to the country’s digital ambitions. He said, “Writer’s entry into Sri Lanka reflects our belief that digital ambition in regulated environments must be supported by trust, sound governance, and strong execution. As institutions scale digital services, the reliability of information and payment systems, channel operations, and governance frameworks becomes increasingly important to public and institutional confidence. Our experience across information management, digital transformation, and enterprise payments enables us to support secure, large-scale financial ecosystems, with a clear commitment to building and leading these capabilities locally.”

Sri Lanka’s Digital Personal Data Protection framework raises expectations around how personal and sensitive information is secured and governed.

Business

Altair issues over 100+ title deeds post-ownership change

Altair Residences have, over the past six months, seen more than 100 individual title deeds being executed by apartment owners, providing owners with a clear, registered, legal title to their apartments in accordance with Sri Lankan property law. This has been a key initiative by the new owners and management of Altair to improve governance and will continue in an orderly manner in the coming months.

With the transition of ownership to Blackstone India, Altair’s Management Council has also been formally constituted, enabling owners to play an active and proactive role in the management of the Altair building. In addition, the management council has appointed Realty Management Services (RMS), a subsidiary of Overseas Realty Ceylon PLC, as the new facility manager of Altair.

Commenting on these milestones, Thilan Wijesinghe, Chairman of TWC Holdings, who, together with a team from TWC, represents Blackstone’s interests in Sri Lanka, said, “The issuance of individual title deeds is a critical step in any professionally developed residential asset. Over the past six months, this process at Altair has moved forward in a structured and transparent manner, alongside the formal establishment of owner-led governance. This, combined with the appointment of experienced facility managers are fundamental building block for long-term value-creation for apartment owners and proper asset stewardship.”

With ongoing improvements to the building being undertaken by Indocean Developers Pvt Ltd (IDPL), the owning company of Altair, the issuance of deeds to owners is expected to accelerate over the coming months.

-

Business5 days ago

Business5 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business6 days ago

Business6 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion6 days ago

Opinion6 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Business2 days ago

Business2 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion23 hours ago

Opinion23 hours agoSri Lanka, the Stars,and statesmen

-

Opinion5 days ago

Opinion5 days agoLuck knocks at your door every day

-

Business7 days ago

Business7 days agoDialog Brings the ICC Men’s T20 Cricket World Cup 2026 Closer to Sri Lankans

-

News6 days ago

News6 days agoRising climate risks and poverty in focus at CEPA policy panel tomorrow at Open University