Business

Sampath Bank reports stable results amidst economic headwinds

Ptofit After Tax showed reduced improvement due to higher tax expenses

Only a marginal drop in its Net Interest Income thanks to stringent management

Backed by its strong capital base, Sampath Bank continues to navigate adeptly through challenging times. The Bank demonstrated resilience and a commitment to prioritizing stakeholder interests in the face of challenging economic headwinds, thanks to its well-executed business strategies, increased vigilance, and proactive risk management measures.

Despite the country showing signs of a broader economic upturn in 2023, Sampath Bank remained steadfast in supporting customers who continued to experience stress due to pressures accumulated over the past few years. Spearheaded by its Credit Nursing Unit, the Bank offered a variety of relief measures, including tailor-made repayment plans, restructures, and rescheduling solutions, to provide much-needed breathing space for distressed customers. This enabled them to focus on revitalizing their businesses. Additionally, the Bank provided financial counseling and business advisory services to empower customers to access fresh equity, seed capital, and other resources to transform their business models. This initiative was aimed at creating stronger and more resilient businesses capable of thriving in an increasingly uncertain world.

Notwithstanding challenges in the external operating environment, the Bank engaged in its CSR commitments with renewed vigour to initiate various projects under its flagship “Weweta Jeewayak” program contributing to rural economy growth. In addition, the Bank gave enhanced focus to contribute to the country’s climate action goals by increasing investments in the “A Breath to Ocean” initiative aimed at restoring the oceanic ecosystems, particularly in turtle conservation, coral restoration and mangrove rehabilitation.

Regardless of continuing uncertainties and challenging economic conditions throughout the year, profitability remained in line with expectations as the Bank’s Profit Before Taxes on financial services stood at Rs 38.4 Bn which is a 89.9% increase over the previous year’s achievement of Rs 20.2 Bn.

However, considering the impact of higher tax expenses, the Profit After Tax (PAT) demonstrated a reduced improvement of 30.5%, rising from Rs 13.1 Bn in the previous year to Rs 17.1 Bn for the year ended 31st December 2023.

The Group remained resilient with a profit after tax of Rs 17.9 Bn for the year under review, reflecting a 27.5% growth over the previous year.

The Net Interest Income (NII) for the year amounted to Rs 72.3 Bn, indicating a marginal 1.6% decline year on year, primarily due to the increase in interest expenses for FY 2023 surpassing the increase in interest income. Interest income increased by Rs 45.8 Bn in the year under review, marking a 29.1% improvement compared to the previous financial year, while interest expenses surged by 55.9% year on year reaching Rs 131.2 Bn. Despite this significant disparity, timely re-pricing strategies, coupled with stringent management of both asset and liability portfolios amidst the backdrop of the declining AWPLR, helped contain the impact on the Bank’s NII, ensuring only a marginal drop. The Net Interest Margin (NIM) for the year was 5.16%, compared to 5.66% reported in the previous year.

Tax expenses on financial services saw an increase of Rs 3.4 Bn, rising from Rs 5.2 Bn in FY 2022 to Rs 8.6 Bn in FY 2023. This growth is attributed to the combined impact of the overall expansion in the tax base and the application of SSCL for the entire year. Income tax too witnessed a substantial increase of 567.7% from Rs 1.9 Bn in FY 2022 to Rs 12.6 Bn in FY 2023. This surge is attributed to the expanded tax base and the application of a higher tax rate of 30%, introduced in the second half of 2022, throughout the year 2023.

Business

SIA warns of 1,000 SME collapses, urges fair policies to protect Sri Lanka’s rooftop solar sector

By Sanath Nanayakkare

The Solar Industries Association (SIA), representing over 1,000 companies and employing 40,000 workers in Sri Lanka’s rooftop solar sector, issued a stern warning recently regarding threats to the industry’s survival and the nation’s renewable energy ambitions. The association condemned recent regulatory instability and called for urgent policy reforms to avert economic and social crises.

The SIA categorically rejected the Ceylon Electricity Board’s (CEB) claim that rooftop solar installations caused the recent island-wide power outage, calling the accusation “baseless and misleading.”

“Public trust is eroded when accountability is misdirected,” the SIA stated. “We demand an independent, transparent investigation led by experts appointed by the Ministry or the Public Utilities Commission (PUCSL). The CEB’s unilateral statements disregard the sector’s contributions and jeopardize Sri Lanka’s renewable energy transition,” they said.

“While acknowledging the formation of a tariff determination committee, the SIA criticized its narrow focus on financial parameters, ignoring the sector’s socioeconomic value. Rooftop solar empowers businesses and households with energy independence, reduces grid strain, and supports climate goals. However, proposed volatile tariff structures risk destabilizing over 100,000 installations—primarily owned by middle-class families—and deter future investment,” they noted.

“A rigid, equation-based tariff system is unsustainable,” the association warned. “Sri Lanka needs a stable policy framework to attract long-term investments. For instance, retirees could invest EPF savings into solar projects, securing income while advancing national energy targets. Without urgent action, 1,000 SMEs and 40,000 jobs face collapse, with dire consequences for employment, energy security, and economic stability,” they pointed out.

SIA urged policymakers to establish an independent committee to investigate the power outage fairly, expand the tariff committee’s mandate to include socioeconomic and environmental benefits and implement predictable policies to safeguard SMEs, households, and investor confidence.

“Sri Lanka stands at a crossroads,” the SIA emphasized. “Protecting rooftop solar isn’t just about energy—it’s about livelihoods, economic resilience, and a sustainable future. We urge stakeholders to collaborate on solutions that prioritize both people and progress,: they emphasized.

Business

SLT-MOBITEL partners with the Rush Lanka Group to power its apartment portfolio

SLT-MOBITEL has entered into a strategic partnership with Rush Lanka Group to provide exclusive SLT-MOBITEL Fibre connectivity solutions to their portfolio of luxury apartment developments in Colombo and the suburbs, enhancing the digital experience of all residents.

The agreement was signed between Imantha Wijekoon, Chief Business Officer of Consumer Business at SLT, and Zaid Ariff, Director of Construction at the Rush Group headquarters. Representatives from both companies also attended the ceremony.

Under the partnership, SLT-MOBITEL will serve as the exclusive digital service provider for five prestigious Rush Lanka developments including Street Rush Residencies and Rush Court 4 in Mt. Lavinia, Rush Tower 2, Rush Metropolis in Dehiwala, and Rush Court 5 in Colombo 14. The collaboration ensures residents will enjoy superior fibre connectivity speeds, enabling seamless digital experiences in modern smart homes. The partnership with the Rush Lanka Group aligns with SLT-MOBITEL’s commitment to offer ultra-fast, reliable connectivity solutions to residential developments. Delivering exclusive fibre connectivity to luxury apartments, SLT-MOBITEL ensures residents have access to world-class digital services that complement the living experience promised by Rush Lanka Group.

Powered by advanced fibre technology, SLT-MOBITEL network will provide the residences with seamless performance across digital activities. The SLT-MOBITEL Fibre backbone ensures lag-free experiences whether tenants are gaming online, attending virtual classes, working remotely, or streaming high-definition entertainment. SLT-MOBITEL Fibre will transform the lifestyles of all apartment users bringing greater convenience and superior quality of life.

Rush Lanka Group, established in 1992, is a property developer specializing in luxury and semi-luxury apartments.

Business

Sri Lanka makes outstanding appearance at OTM and SATTE 2025 in India

Starting its promotional work for 2025, Sri Lanka Tourism Promotion Bureau (SLTPB) added another feather into its cap of endorsements, by being recognized as the most innovative Tourism Board promotion in Outbound Travel Mart (OTM) . In parallel to that, several other sub events were held. The OTM was held in Jio World Convention Centre, Mumbai—India, from 30th January to 01st February 2025.Before OTM, the Global Village – Global Exchange & Trade Exhibition was held at the Surat International Exhibition & Convention Centre , Sarsana, Surat (Gujarat – India , from 25th to 27th January 2025. This travel fair was organized by Southern Gujarat Chamber of Commerce and Industry (SGCCI).

Sri Lanka participated in both OTM and South Asia’s Travel & Tourism Exchange (SATTE), held from 19th – 21st Feb 2025, in New Delhi, India . This was an excellent opportunity for Sri Lanka to promote it’s potential as a unique travel destination, especially for the Indian counterparts, as SLTPB has identified India as the number one source market for Sri Lanka, tourism bringing the largest number of tourist arrivals to the destination.

-

Editorial6 days ago

Editorial6 days agoRanil roasted in London

-

Latest News7 days ago

Latest News7 days agoS. Thomas’ beat Royal by five wickets in the 146th Battle of the Blues

-

Features6 days ago

Features6 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Opinion5 days ago

Opinion5 days agoInsulting SL armed forces

-

Features6 days ago

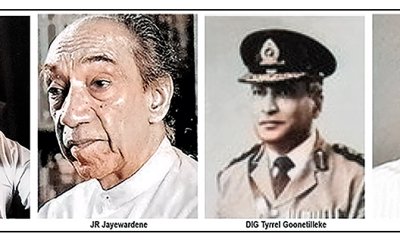

Features6 days agoMr. JR Jayewardene’s passport

-

News3 days ago

News3 days agoAlfred Duraiappa’s relative killed in Canada shooting

-

Features6 days ago

Features6 days agoAs superpower America falls into chaos, being small is beautiful for Sri Lanka

-

Opinion6 days ago

Opinion6 days agoBeyond Victory: sportsmanship thrives at Moratuwa Big Match