Business

‘Ceylinco VIP Drive Thru Claims’ – an amazing solution for customers who do not obtain On the Spot claims

Ceylinco General Insurance, the company that gave the world the ultimate in claims settlement – the On the Spot claim settlement process, now offers another amazing solution – ‘Ceylinco VIP Drive Thru Claims’ facility. This unique facility is offered to ‘Ceylinco VIP’ customers who have not obtained On the Spot claims due to various reasons such as the owner not being available at the time of the accident or in the event the vehicle is under a leasing facility. Now all a customer has to do is just drive in, pick up their claim via cash or cheque and leave in no time at all, and with no hassle.

Patrick Alwis, Managing Director and CEO of Ceylinco General Insurance, elaborating on the new initiative said, “’Ceylinco VIP Drive Thru Claims’ facility offers customer convenience and a time-saving solution when collecting claim settlements. Staff at ‘Ceylinco VIP Drive Thru’ centres are equipped with hi-tech equipment and are empowered to offer the required services without red tape. Customers who do not opt to obtain claims using the On the Spot facility will be notified in advance via SMS of the pending items, if any, and documents required. Once the documents are handed over at the Dive Thru Centre, within a few minutes the cheque or cash will be given to the customer.”

Ajith Gunawardena, chairman and CEO of Ceylinco Insurance PLC, commending Ceylinco General Insurance for developing this concept said, “Ceylinco General Insurance is always looking for innovative, new ways to bring value and convenience into the lives of its customers. Ceylinco VIP Drive Thru Claims facility is a result of its customer-centric approach, offering timely solutions and a speedier service, which is a hallmark of the company”.

Initially located in four main cities, this drive thru facility will be extended to all other areas covering the entire island in the near future. The initial locations are at No 126, High Level Road, Nugegoda; Vidyaloka Lane, Mihindu Mawatha, Kurunegala; No 6, Gamini Dissanayake Road in Kandy; and K L H Hinniappuhamy Mawatha, Wakwella Road in Galle. Situated in easy-to-access locations in the respective cities, all four centres offer ample parking and specially reserved slots for Ceylinco VIP customers using the Drive Thru Claims facility. These centres will be open six days of the week, from Monday through Saturday from 8.30 am to 6.00 pm. Customers insured with any branch, in any part of the island, can collect their claims from any of the ‘Ceylinco VIP Drive Thru Claims’ centres according to their convenience.

Business

‘Port City Colombo makes progress in attracting key investments’

Port City Colombo, a multi-service Special Economic Zone (SEZ) and a regional financial centre and business hub, has made significant progress in capturing key investments, as the project gears up for a tenacious drive to attract prospective land development and business set-up investors from the South Asian, APAC, and Middle Eastern regions before the end of 2024, a Port City Colombo press release said.

The release added: ‘With a strong emphasis on capturing high-value Foreign Direct Investments, Port City Colombo has on-boarded approximately forty-one companies registered as Authorised Persons (AP’s), as approved by the Colombo Port City Economic Commission. Fifty-two percent (52%) of the project’s Marina District, which includes South Asia’s first-ever luxury yacht marina and 5-star hotel, has further already attracted investment. Reputed international and local corporate entities, including Asiri Port City Hospital (Private) Limited, TIQRI, CODEGEN INNOVATIONS, 99x Technology AS, IVIVA PTE Ltd, Echelon Trade (Pvt) Ltd, and Port City BPO (Pvt) Ltd, have been additionally designated as Businesses of Strategic Importance.

‘Approximately more than twenty prospective investors are presently in the pipeline to register as Authorised Persons, demonstrating strengthened confidence in Port City Colombo’s positive outlook as a competitive regional investment hotspot.

‘Positioned within the Colombo Port City Special Economic Zone, Port City Colombo presents a low-risk financial environment that enhances the ease of doing business for global investors in Sri Lanka, whilst being economically ring-fenced against domestic macroeconomic challenges. This visionary FDI investment destination also showcases a thriving commercial ecosystem and liveable master-planned city, enabling a diversity of businesses to set up operations against the backdrop of transactions in 16 different international currencies with no capital or exchange controls, 100% foreign ownership, and fiscal incentives for 25 plus years.

‘Port City Colombo provides investors two primary options of investment: land development investments, which include residential and commercial property development, and business set-up and investments, which encompass a variety of opportunities in IT/ITes, financial services, hospitality/tourism, logistics, and so forth. Commercial entities, who are interested in investing or setting up business operations, are required to become qualified as an Authorised Person, which is defined as any individual or entity permitted by the Colombo Port City Economic Commission (CPCEC) to conduct business within the vicinity and from the area of authority of the Colombo Port City Special Economic Zone.

‘As Port City Colombo progresses forward with its vigorous AP and BSI drive, the project aims to fulfil the ambition of transforming Sri Lanka into an attractive global investment destination, whilst emulating the successful international economic models of Dubai and Singapore. For more information about our investment opportunities, please visit www.portcitycolombo.lk. ‘

Business

India is no ‘big brother’ to Sri Lanka, H.C. Santosh Jha says in myth-busting speech

by Sanath Nanayakkare

India is referred to as a ‘big brother’ state for the South Asian region as it is the largest and most powerful country in South Asia.

However, the Indian High Commissioner to Sri Lanka Santosh Jha delivering a speech in Colombo on April 21, busted this myth adequately.

Speaking at the official launch of the “Ramayana Trail – The Sacred Mission” Project organised by the Supreme Global Holdings Group at Hotel Taj Samudra, Colombo, the Indian High Commissioner said that ‘Ramayana Trail’ reaffirms his oft-repeated assertion that the two countries are civilisational twins sharing the same antiquity.

“From this it follows that we are not after all big or small sisters or brothers but one of the same age and antiquity with neither being small or big vis-a-vis each other,” he said, addressing the audience that comprised a delegation from India led by Swami Govind Dev Giriji.

Speaking further, the Indian HC said,” Your presence here confirms that the deep connection between the people of two countries goes back several centuries into antiquity. A time when people and ideas were moving across seamlessly and without the modern impositions that sometimes constrain and restrict easy travel and connections between our peoples. We were reminded of this connect recently by President Ranil Wickremesinghe who mentioned at the launch of the Universal Payments Interface or the UPI in Sri Lanka, which will allow Indian tourists to make payments in Indian rupees in Sri Lanka, there is evidence of the use of each other’s coins or ancient currencies in both India and Sri Lanka deep into our antiquity.”

“We all know today that the Ramayana trail stretches from India to Sri Lanka. That this is so was not so well known to many in our two countries even a decade or so ago despite references to this in our ancient epics such as Ramayana and Mahabharata. I myself discovered this first hand when I came to Sri Lanka in 2007 and worked at the Indian High Commission for three years.

‘’I had the pleasure of visiting these places in Sri Lanka multiple times during that period.”

“So far, in my present tenure too I have visited some of these places and more are part of my plans in the near future. I am, therefore, glad that today the idea of Ramayana trail has caught up the imagination of the people on both sides of the Palk Strait.”

“Promoting tourism is an important objective of both our countries. For Sri Lanka, in particular, it has been an important source of economic activity and promotion of Ramayana trail holds a significant promise.”

“I must also recall that our leaders have pledged to promote the Buddhist circuit and the Ramayana trail in both our countries in the Vision Document that was issued when our leaders – President Ranil Wickremesinghe and Prime Minister Narendra Modi – had their summit meeting in New Delhi in July 2023. I must add that this is the vision of our leaders that guides our actions today in all areas.”

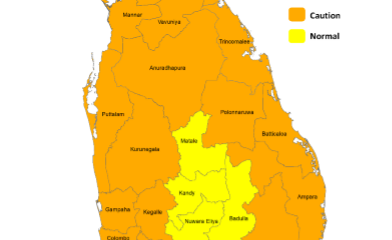

“India already contributes more than 1/5th of the tourist arrivals into Sri Lanka. India is also the largest source of tourist traffic to Sri Lanka. Unlike others, Indian tourists also visit both Buddhist and Hindu places of worship. They are also attracted to historical sites existing across Sri Lanka. In that sense, they are more diversified in their choice of sites and places they visit in Sri Lanka. The economic value of attracting Indian tourists into Sri Lanka, therefore, is greater as the benefits of their travels go to a larger cross section of people dependent on tourism business and to those who are located in all the provinces in Sri Lanka.”

“In other words, Indian tourism has a larger regional spread in Sri Lanka and so its benefits too are similarly more dispersed and distributed. This is unlike other tourists, who are mostly interested in adventure and beach tourism and therefore their business benefits have more limited spread and distribution.”

“Our effort to establish the land bridge, on which we have begun our joint work, promises to further provide fillip to our ongoing efforts to promote tourism between our two countries. No doubt that it will be a game changer. It will, of course, bring many benefits to communities along the alignment of this connectivity but more specifically, it will make Ramayana and Buddhism tourism easier and more alluring to people on both sides. I must also add that the Ramayana trail also confirms the deep people-to-people connect and shared civilisational antiquity of India and Sri Lanka.”

“Our relationship is special and unique in this respect. For us, we have to cooperate as that is the only option. We must stand hand-in-hand with each other in good as well as difficult times. We cannot rest with just coming to assist one another episodically but must remain engaged at all times in all spheres.”

“Our commitment to one another has to be the greatest as there is no other relationship that is more vital, critical and natural as the one we have with each other. In fact, in modern political and economic systems, too, we are similar. We are democratic, open polities and societies and open market economies.”

“Our socio-economic profile as a low middle income country also entails that we can offer each other the benefits of our respective successful experiences, which no other society, economy or polity can do, especially those which are not governed by these democratic norms.”

Business

Rainbow Pages Champions League: 28 leading companies battling for victory

A six-a-side soft ball corporate cricket tournament was successfully held at the G H Buddhadasa Ground in Battaramulla recently with the participation of 28 teams representing leading companies in the island. The tournament was organized by the Rainbow Pages Welfare Society. Rainbow Pages is the National Business Directory in Sri Lanka managed by SLT-MOBITEL group.

The teams in the semi-finals were Winners Global, Sonasu Connect, GM Garments, and Salota International. Winners Global won the championship, while GM Garments and Salota International were both named co-runners-up in the Champions League corporate cricket tournament.

-

Business4 days ago

Business4 days agoCEAT Kelani launches three new radial tyre variants in ‘Orion Brawo’ range

-

Business6 days ago

Business6 days agoDialog-Airtel Lanka merger comes centre stage

-

Business3 days ago

Business3 days agoCeyline Travels and MBA Alumni Association of University of Colombo sign MOU

-

Business6 days ago

Business6 days agoSLFEA appoints JAT as a Facilitation Partner for training painters to provide overseas employment opportunities

-

Business4 days ago

Business4 days agoHayleys Fabric celebrates triple triumph at ISPO Textrends Spring/Summer 2026

-

Business5 days ago

Business5 days agoUrgent appeal from Sri Lankan exporters on rupee appreciation

-

Business3 days ago

Business3 days agoMaldivian to launch direct flights to Colombo

-

Sports4 days ago

Sports4 days agoHello Madras, ‘ai api kaluda?’