Editorial

Welcome tax relief for elders

The Finance State Minister is reported to have said that the Government of Sri Lanka (GOSL) has decided to refund the five per cent withholding tax levy (WHT) deducted on the interest income of senior citizens after September 10 in case the interest income is less than Rs. 100,000 per month. He said this decision was taken with the Finance Minister, who is also the President, after considering the situation of senior citizens and the many requests to refund the WHT.

The State Minister also said, “We negotiated with the Inland Revenue Department (IRD) to refund the five per cent deducted as WHT for senior citizens, and accordingly, they agreed to refund the amount deducted from September 10.”

The decision by GOSL will undoubtedly bring some cheer to those who stand to receive the refund. By enforcing a five percent WHT at source, the GOSL collected taxes even from those not liable to income tax, assuming their total income for the year was less than Rs. 1.2 million.

We need further details on how the refund will be operationalized because getting any refund of taxes overpaid from the IRD has been historically nearly impossible. It is possible that the GOSL may ask the Banks who initially deducted the WHT to effect the refund to the senior citizens. In return, the banks will be either refunded this amount or allowed to set it off from future WHT to be remitted.

However, the State Minister or IRD must clarify an important question. How will the IRD or the Banks ascertain whether a senior citizen who claims a refund has multiple fixed deposits across banks where the monthly interest will exceed the threshold of Rs. 100,000 per month? It will be recalled that the President recently stated there are nearly 55 million fixed deposits amongst the population of 22 million.

Given that many within the 22 million don’t hold any fixed deposits, the probability of a person having multiple fixed deposits across more than one bank is relatively high.

Another problem that will be encountered is where interest is paid on FD’s maturity and where the tenor might be three, six months or twelve months. Who will monitor whether the cumulative interest for the year will be less than Rs 1.2 million and whether WHT should be refunded or not deducted? The State Minister did not say whether a senior citizen claiming a WHT refund should have a tax file opened at the IRD. If such a requirement exists, most senior citizens hoping for a quick refund will be disappointed.

An alternative would be to obtain a signed declaration from the deposit holder that his monthly income is less than Rs 100,000 or that his annual income is less than Rs. 1.2 million. This was the methodology used when the GOSL requested the Banks to pay an interest of 15% to senior citizens on a single deposit of Rs. 1.5 million. Whether there was widespread abuse, with senior citizens submitting multiple declarations to several banks and earning the enhanced interest rate, is unknown. However, many banks have complained that they are yet to receive the amount due to them from the GOSL.

The GOSL annual estimate for the collection of Income Tax was Rs 100 billion, of which Rs. 70 billion has been collected in the first six months. Therefore, it is reasonable to assume that the annual target will be well exceeded. As such, the GOSL can afford to extend some concessions to the senior citizens and those in the middle class with only salaried income who have been most affected by the new tax rates and reduced thresholds.

The Member of Parliament and Chairman of the Sectorial Oversight Committee has, over the last year, on several occasions disclosed some abysmal figures in terms of the number of tax files opened by individuals, the paltry amount paid by them as taxes and that of the 105,000 companies in the books only 15,000 pay any taxes.

He has also alluded that certain Inland Revenue, Customs and Excise Department officers are under performing in collecting taxes, and GOSL must restructure all three to achieve the goals in terms of tax collection. It will be interesting to know how many MPs have a tax file and how many file their annual returns and pay taxes.

Undoubtedly, the lack of digitization in the country is a severe drawback in many aspects, including collecting taxes and refunds due to taxpayers being processed. In most developed and developing countries, citizens need a tax file number when dealing with financial institutions. In Australia, when an individual fills out their electronic tax return, the box where bank interest income needs to be disclosed is already filled with the interest income earned from various banks. This is possible because the banks have submitted the relevant information to the tax authorities based on the tax file number of the deposit holder.

The importance of the country’s digitization can not be overemphasized, and the recent initiative by the GOSL to commence this with assistance from India is a step in the right direction. However, once again, a statement made by the Minister of Public Security that he will not allow a foreign company to have access to the blood group of our citizens indicates that there will be unnecessary delays based on unfounded concerns.

Editorial

Don’t eviscerate precious goose

Thursday 27th February, 2025

The proposed 15% services export tax exemplifies Sri Lanka’s deceptive taxation policy. The NPP government’s Budget 2025 has listed it as a corporate tax, but according to a Bill seeking to amend the Inland Revenue Act, the new tax will apply to all individuals who provide services to external parties and earn foreign exchange. Not even freelancers will be spared. The tax in question will apply to money brought back to Sri Lanka through the banking system.

The services export tax is bound to hinder Sri Lanka’s forex inflow and deliver a crippling blow to the country’s budding tech industry. It may drive Sri Lankan IT professionals working for foreign firms and bringing much-needed forex to park their earnings overseas and/or use informal forex transfer systems such as Hawala and Undiyal bypassing the banking system.

The living conditions of many Sri Lankans who have gone overseas for employment, for want of a better alternative in view of the current economic crisis, are far from satisfactory. Most of these workers are doing odd jobs or have fallen prey to racketeers, as evident from the predicament of dozens of Sri Lankans trapped in the cyber slave camps in Myanmar. Therefore, it defies comprehension why the Sri Lankans earning foreign exchange and helping shore up the country’s forex reserves, without migrating, are not incentivised to earn more in foreign currency instead of being discouraged with taxes.

The government is desperate to increase its revenue to 15% of GDP in keeping with an IMF bailout condition. But in a bid to rally popular support ahead of an election, it has proposed in its Budget 2025 pay hikes for the public sector workers and some relief measures which will take a heavy toll on the state coffers. It is also planning to expand the state service, which is already bursting at the seams, by recruiting as many as 30,000 workers. It cannot increase the existing taxes any more, and its promise to save funds by curtailing state expenditure remains largely unfulfilled. So, it has resorted to measures such as the services export tax regardless of their adverse consequences.

Some international tech companies are expanding their operations in Sri Lanka, and this means more jobs for the local youth and a boost to the country’s forex inflow. The new tax at issue is fraught with the danger of driving those companies as well as talented Sri Lankan youth out of the country. Some of these companies are reportedly planning to shift their operations to other South Asian countries which are offering numerous concessions to them. Is the NPP government promoting foreign investment in other countries? It has failed to be different from its predecessors. It has not been able to attract adequate foreign direct investment despite its braggadocio. It is upbeat about a proposed foreign oil refinery, but cannot specify the economic benefits, which, it says, will accrue to this country! It should try to increase the forex inflow through available sources such as those who work for international firms and earn in foreign currency without leaving the country. These professionals can also be considered Rata Viruwas (an honorific politicians use for expatriate workers), though based here. They deserve encouragement.

It is hoped that the government will give the proposed services export tax a rethink. It must not eviscerate the goose that lays the golden eggs. Let it be urged to explore alternative ways and means of increasing its revenue, such as downsizing the state sector and rationalising its welfare expenditure. It is reportedly planning a heavily subsidised basket of goods in view of the local government polls slated for April. This is an election bribe or chanda gundu. What has the country gained from the fuel subsidy for fishers? The fertiliser subsidy has not helped bring down the prices of rice. Paddy farmers are refusing to sell their produce to the state-owned Paddy Marketing Board, which is trying to build a buffer stock to regulate the rice market.

The Opposition has claimed during the budget debate that online casino is not taxed. If so, why has the government baulked at imposing a new sin tax to boost its revenue and chosen to commit the sin of strangling the local tech sector and driving more Sri Lankan professionals out of the country? If it manages state funds frugally and streamlines revenue collection, it will be able to reduce its overdependence on tax and tariff increases and new taxes.

Editorial

Budget and security

Wednesday 26th February, 2025

The NPP government’s maiden budget was passed with a two-thirds majority at the second reading vote yesterday. It will now go into committee stage for further review. That the ayes would have it was a foregone conclusion. However, the events that unfolded in the run-up to yesterday’s budget vote were oddly interesting.

President Anura Kumara Dissanayake presented Budget 2025 in Parliament on 17 Feb. Thereafter, a debate thereon got underway. Two days later, an underworld kingpin, called Ganemulle Sanjeewa was killed inside a courtroom. That incident was followed by the custodial deaths of two suspected murders, and the focus of Parliament shifted from the budget to public/national security for all intents and purposes. The same holds true for the media and the public; they too have remained preoccupied with the narratives about those killings and the security implications thereof. An analysis of media content during the past few days will bear this out.

The economic crisis is far from over, and the country is still under a pall of uncertainty, which shows no signs of going away anytime soon. This is a time when the government, the public and the media must remain maniacally focused on the economic front. But threats to public/national security, real or otherwise, have taken centre stage, eclipsing the country’s fiscal plan for the current year. One may call it a case of misplaced priorities, but it is something the government should take cognisance of.

Given the high level of public outrage that the killing of a crime czar inside a courtroom and two extrajudicial killings have sparked, how serious the situation would be if harm were to befall a prominent figure, say a popular political leader, is not difficult to guess. Hence the need for the government to ensure that VIP security, especially for its rivals, is not compromised while doing everything possible to protect the public and neutralise threats to national security. Mere rhetoric won’t do.

Last week’s daring underworld attack inside a courthouse has made a mockery of threat assessment under the current dispensation. The acting IGP Priyantha Weerasooriya told the media the other day that Ganemulle Sanjeewa had not been taken to a court in Gampaha recently in view of an intelligence warning that he would be targeted there. But the police took him to the Colombo Magistrate’s Court, the following week! We are reminded of the circumstances that led to the Easter Sunday carnage in 2019. Some of those who were blamed for failing to prevent those terror attacks, despite the availability of actionable intelligence, are back in key positions in the public security sector!

The leaders of the JVP, which was responsible for quite a few political killings in the late 1980s, cannot be unaware that terrorists and other killers have to be lucky only once, as the IRA told Prime Minister Margaret Thatcher. A solo gunman/ bomber can plunge a country into chaos and unsettle a government, or even cause its collapse, however powerful it may think it is.

One may recall that a 17-year UNP regime’s fate was sealed the day former minister and leading Opposition figure, Lalith Athulathmudali, was assassinated. That tragedy which shook the country sparked political upheavals, in 1993, setting in motion a process that led to the collapse of the UNP’s rule the following year. The political backlash from Lalith’s assassination prompted President Ranasinghe Premadasa to throw caution to the wind, despite terrorist threats, and go among the people during a May Day rally, a few days later, presumably in a bid to boost the sagging morale of the UNP’s rank and file. The rest is history.

Sri Lankan politicians do not learn from history. The Mahinda Rajapaksa government curtailed former Army Commander Gen. Sarath Fonseka’s security as he had entered the presidential fray in 2010. Thankfully, the LTTE had been defeated by that time. But the Easter Sunday terror attacks happened a decade later. Today, the underworld is unusually active, and the possibility of attempts from other quarters to destabilise the country cannot be ruled out. One can only hope that the government will act prudently.

Editorial

Chaotic House and moral compass

Tuesday 25th February, 2025

The JVP-led NPP government, to give credit where credit is due, has already set two examples worthy of emulation. It had Speaker Asoka Ranwala step down when he failed to prove his claim that he had a doctorate. It has also had the courage to take exception to some degrading remarks Deputy Minister Nalin Hewage made about SJB MP Rohini Wijerathna last week.

Chief Government Whip Dr. Nalinda Jayatissa promptly requested the Chair to expunge the offensive words from the Hansard when the SJB raised objections. NPP MP Kaushalya Ariayaratne condemned, in a Facebook post, what Hewage had said. Prime Minister Dr. Harini Amarasuriya has also gone on record as stating that such remarks should not have been made. Way to go!

Hewage should have known better than to make such remarks, and there is no way he can justify them. Now that the government has expressed disapproval of his disparaging remarks, the matter should be considered closed. But the Opposition has a propensity to blow issues out of proportion to gain political mileage. Let its holier-than-thou members who lack control over their restless tongues and tend to lash out at female MPs at the drop of a hat be urged to follow the example set by the NPP. They ought to remember that nastier things have been said about female MPs in Parliament, which has also witnessed numerous brawls and even a savage attempt to assault and gherao the Speaker. The culprits got off scot-free. Thankfully, most of those rowdies are not in the current Parliament.

The UNP and the SLFP as well as their offshoots, the SJB and the SLPP, respectively, are without any moral right to condemn others for mistreating women. The UNP’s 17-year rule (1977-1994) began with a presidential pardon for a notorious rapist serving a jail. UNP politicians and their supporters also stripped female SLFP activists naked in public during the post-election violence spree in 1977. The SLFP, which produced the world’s first female Prime Minister, humiliated a group of female UNP activists in a similar manner in the run-up to the North-Western Provincial Council election in 1999.

Most of the Opposition MPs who have taken up the cudgels for Rohini’s rights—and rightly so—were in the previous Parliament, but they never so much as made a whimper of protest when MP Diana Gamage was vilified in the House. After crossing over to the government from the SJB, Diana had to suffer many indignities at the hands of some male SJB MPs who would spew out streams of suggestive remarks whenever she rose to speak in the House. She sought to get even with them, but hers was a futile effort like a badger’s fight against a pack of mastiffs.

We urge the party leaders to take up the issue of harassment of female MPs and rein in unruly elements in their parliamentary groups. This is the best way to clean up Parliament.

Meanwhile, the female members of the Provincial Councils and local government institutions were in a far worse predicament than the women MPs. Reams were written about the harassment of female local councillors, some of whom were even shouted down at council meetings. The situation became so bad that the victims sank their political differences and formed a front to fight for their rights.

Successive governments have striven to increase women’s representation in political institutions and made laws to achieve that end, but without much success. A quota has been introduced for women in the LG institutions. There is a pressing need for decisive action to safeguard their rights. This is something the NPP government should give serious thought to, with the next LG polls only a few weeks away. It ought to extend its Clean Sri Lankan initiative to keep the local councils to be elected in April free from harassment, sexual or otherwise. Other political parties which are making a public display of their commitment to protecting women’s rights, too, should assign high priority to the task of ensuring that LG institutions will have zero tolerance of the harassment and intimidation of female councillors.

-

Business3 days ago

Business3 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports4 days ago

Sports4 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

News6 days ago

News6 days agoKiller made three overseas calls while fleeing

-

News5 days ago

News5 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features4 days ago

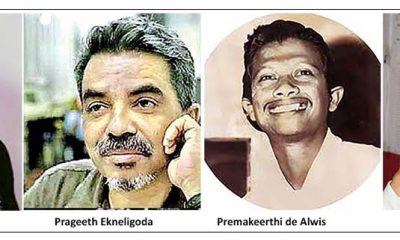

Features4 days agoThe Murder of a Journalist

-

Features4 days ago

Features4 days agoExcellent Budget by AKD, NPP Inexperience is the Government’s Enemy

-

Sports4 days ago

Sports4 days agoMahinda earn long awaited Tier ‘A’ promotion

-

News5 days ago

News5 days agoMobile number portability to be introduced in June