Business

‘JAT posts stellar Q2 – doubles PBT and commences manufacturing in Bangladesh’

JAT Holdings PLC has posted exceptional financial performance for Q2 of FY 2022/23. During the Quarter, the Group also achieved a major milestone, delivering on its key IPO promise, by inaugurating its own end-to-end state-of-the art manufacturing facility in Bangladesh. Simultaneously, JAT Holdings PLC also recorded its highest-ever revenue for Q2 in history, doubling its profit before tax, compared with the corresponding period in the year prior.

Accordingly, JAT Holdings PLC noted a YTD revenue growth of 40% during the period, concurrently managing to increase gross profit margins amidst the most challenging economic environment in its history, clearly demonstrating the Group’s strategic and fiscal prowess.

Gross Profit margins grew during the period under review amidst a deepening economic crisis, material scarcity in global markets and foreign exchange outflow restrictions. The Group’s strategy of purchasing raw materials in bulk and maintaining adequate stocks for at least 6 months at all times, allowed the enterprise to benefit from economies of scale, while JAT Holdings’ prudent and effective waste management efforts helped to improve productivity and efficiency. As a result, operating profit also recorded a healthy growth of 111% during the period under review, supported by cost management efforts, which helped manage input cost inflation and foreign exchange volatility. Profit Before Tax (PBT) and Profit After Tax (PAT) also sustained their recovery momentum, while showing sharp rises in the quarter under review, contrasted with the corresponding period in the previous year.

Commenting on the business momentum, CEO Nishal Ferdinando said, “Supported by our new manufacturing facility in Bangladesh and expert manoeuvring in the Sri Lankan market amidst the toughest business environment we have endured to date, we are pleased to present rock solid financial performance to our investors, and exceptional value to all other stakeholders. Leveraging our excellent relationships with suppliers, we have secured raw materials and shored up our stocks to be able to meet upcoming seasonal demand. The capital raised at the IPO has enabled us to keep borrowing costs to a minimum amidst a tighter monetary environment, which has delivered a positive boost to our bottom line. We intend to move forward with the present momentum and continue to deliver exceptional performance during the remainder of FY 2022/23.”

The Group’s WHITE by JAT range of brilliant white paints grew rapidly, driven by a unique hybrid marketing strategy. Commencement of manufacturing in Bangladesh, coupled with the opening of JAT Holdings PLC’s R&D Centre, another fulfilment of an IPO pledge, helped to drive business momentum during the quarter

Discussing the Group’s strategy and future plans, Founder and Managing Director Aelian Gunawardene added, “Just over a year on from our IPO, I’m pleased to communicate to investors that we have fulfilled the pledges made in our prospectus. We have completed and commissioned our ultramodern end-to-end manufacturing and warehousing facility in Bangladesh, located strategically in close proximity to seaports and our key markets in that country, Dhaka and Chittagong. Our Research and Development Centre is now operational, staffed by teams of experts who will help us to engineer better, cleaner and more efficient products in the future. I am also very pleased to state that the Group as a whole has come together to look after our people amidst the present crises, providing relief allowances and other benefits to help cushion the blow. We are excited about the future and look forward to growing and defending our position as Sri Lanka’s market leader for wood coatings and an emerging giant in the region.”

Since its founding in 1993, JAT Holdings has established itself as a market leader in Sri Lanka for wood coatings and as one of the country’s most promising conglomerates. This is further attested to by accolades such as being ranked amongst Sri Lanka’s ‘Top 100 Most Respected Companies’ by LMD for four years consecutively and also ranking among the ‘Top 20 Conglomerate Brands’ by Brand Finance.

Business

Seylan Bank posts a remarkable PAT of LKR 10 Bn for 2024

The Bank recorded a Profit before Income Tax (PBT) of LKR 16.04 Bn for the period under review with a 59% growth over the previous year, while recording a Profit after Tax (PAT) of LKR 10.05 Bn for the year with a 61% growth over the previous year, demonstrating a robust performance despite challenging macro-economic conditions. The reported PAT of LKR 10 Bn is the highest performance in the Bank’s 36 year history.

Net Interest Income of the Bank was reported as LKR 37 Bn in 2024 compared to LKR 40 Bn reported in 2023 with a decline of 8% corresponding to reduction in Net Interest Margins during 2024, due to reduction in market interest rates throughout the year.

Net fee and commission income of the Bank reported a growth of 7% to LKR 8 Bn compared to LKR 7.4 Bn reported in the previous year. The growth in 2024 was mainly due to increase in income from Cards, Remittances and other services relating to Lending.

The Bank’s net gains from trading reported a gain of LKR 0.46 Bn, a decrease of 44% over the gain of LKR 0.82 Bn reported in previous year due to exchange / interest rate changes.

Net gains / (losses) from de-recognition of financial assets reported a loss of LKR 0.26 Bn in 2024, compared to the gain of LKR 0.15 Bn reported in the previous year. The loss due to the restructuring of SLISBs amounted to LKR 2.71 Bn and was recorded in Q4 2024.

Other Operating Income of the Bank was reported as LKR 1 Bn in 2024, a growth of 5% over the previous year. This increase is mainly from foreign exchange income, which represents both revaluation gain/ (loss) on the Bank’s net open position and realized exchange gain/ (loss) on foreign currency transactions.

The Bank’s Total Operating Income decreased by 11.6% to LKR 44 Bn in 2024 compared to LKR 49 Bn in the previous year mainly due to decrease in net interest income and the loss on restructuring of SLISBs.

The Bank made impairment provision to capture the changes in the macro economy, credit risk profile of customers and the credit quality of the Bank’s loan portfolio in order to ensure adequacy of provisions recognized in the financial statements. The impairment charge on Loans and Advances and other credit related commitments amounted to LKR 6.6 Bn (2023 – LKR 15.5 Bn). The impairment reversal due to the SLISBs exchange amounted to LKR 4.9 Bn (2023 – LKR 1.5 Bn charge).

(Seylan Bank)

Business

An initiative to bring light into the lives of Galle residents

By Ifham Nizam

For decades, many rural communities in Sri Lanka have struggled with an unreliable power supply, outdated infrastructure, and slow responses from authorities. However, a new initiative aims to change this narrative, bringing hope to thousands in the Galle District who have long been in the dark—both literally and figuratively.

Speaking to The Island Financial Review, Dr. Chathura Welivitiya, CEO of HELP-O, an expert in infrastructure development, emphasizes the importance of this project, stating, “Access to reliable electricity is not just about lighting homes; it is about empowering communities, enabling education, fostering business opportunities, and ensuring overall development.”

He said in many villages, the lack of a stable electricity supply has hindered progress. Residents report frequent power outages, damaged lines left unattended for weeks, and new connections taking months—if not years—to be processed. Such issues have not only inconvenienced households but have also impacted local businesses, schools, and healthcare facilities.

According to a Weligama Municipal Council official: “Our children cannot study at night due to power failures. Businesses suffer because they cannot store perishable goods properly. We have raised complaints multiple times, but the response has been slow.”

Recognizing these challenges, a new project has been launched to address the inefficiencies in power distribution. The initiative includes:

Expansion of the Electrification Network: Efforts to extend power lines to remote areas that still rely on kerosene lamps or battery-operated sources.

Upgrading Infrastructure: Replacement of outdated transformers, damaged poles and weak wiring systems to ensure a stable and safe electricity supply.

Community Engagement: A digital reporting system that allows residents to highlight issues in real time, ensuring faster response and accountability from relevant authorities.

Sustainability Measures: Exploration of renewable energy options, such as solar power, to complement the grid and provide backup solutions for power outages.

Dr. Chathura explains, “This project is not just about fixing wires and poles; it is about creating a sustainable and efficient system that meets the growing energy demands of rural areas. Transparency and community participation are key to its success.”

The Southern Province Governor Bandula Haischandra has voiced strong support for the initiative, recognizing its potential to transform rural communities.

“Ensuring a stable electricity supply is a fundamental responsibility of the government, the Governor told The Island Financial Review. “For too long, these communities have been neglected. We are committed to fast-tracking infrastructure improvements and working closely with relevant authorities to resolve longstanding issues.”

The Governor further emphasized the role of accountability and efficiency in the implementation process. “We cannot afford delays and inefficiencies. With the use of modern technology, we are ensuring that complaints are addressed swiftly and that no village is left behind in development.”

Business

Elpitiya Plantations clinches fourth consecutive victory at Inter Plantation Cricket Tournament

Elpitiya Plantations emerged victorious at the 22nd Inter Plantation Cricket Tournament, organised by the Dimbula Athletic and Cricket Club, held on the 21st and 22nd of February 2025 at the Radella Cricket Ground.

The tournament saw participation from 11 plantation companies, showcasing exceptional talent and sportsmanship. Elpitiya Plantations, led by their dynamic captain Wajira Mannapperuma, demonstrated outstanding performance throughout the tournament.

The winning team from Elpitiya Plantations consisted of Wajira Mannapperuma, Asela Udumulla, Dilukshan Neshan, Lakshan Thenabadu, Kavinda Sulochana, Yasitha Koswaththa, Anushka Baddevithana, Kanishka Ranchagoda, Pramoth Bandara, and Sajith Edirisinghe.

In the semi-final match, Elpitiya faced Horana Plantations PLC and secured a decisive victory by bowling out the Horana team for just 20 runs within 4 overs, paving their way to the finals. The final match was a thrilling encounter against Talawakelle Tea Estates PLC, where Elpitiya’s formidable bowling lineup made it challenging for Talawakelle to score. Within the first four overs, Talawakelle’s top batsmen were back in the pavilion, allowing Elpitiya to clinch the championship title with ease.

This victory marks Elpitiya Plantations’ fifth overall win in the history of the tournament and their fourth consecutive triumph, having previously won in 2022, 2023, and 2024. The team’s consistent performance and dedication have solidified their reputation as a formidable force in plantation cricket.

The management of Elpitiya Plantations extends heartfelt congratulations to the team and expresses gratitude to all the supporters and organisers who made this event a grand success.

-

Business3 days ago

Business3 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports4 days ago

Sports4 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

News6 days ago

News6 days agoKiller made three overseas calls while fleeing

-

News5 days ago

News5 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features4 days ago

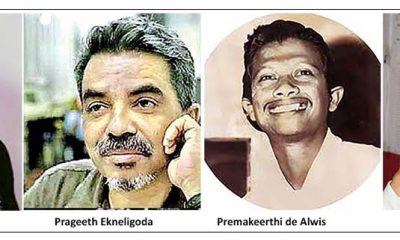

Features4 days agoThe Murder of a Journalist

-

Features4 days ago

Features4 days agoExcellent Budget by AKD, NPP Inexperience is the Government’s Enemy

-

Sports4 days ago

Sports4 days agoMahinda earn long awaited Tier ‘A’ promotion

-

News5 days ago

News5 days agoMobile number portability to be introduced in June